Opinion

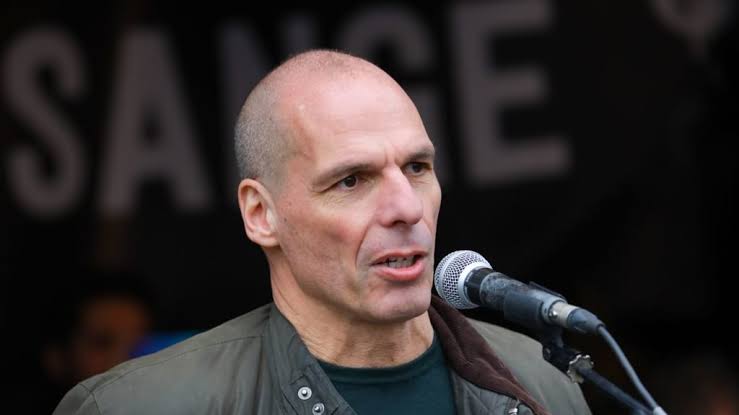

Greece's former Finance Minister says Bitcoin is not suitable to replace money

Yanis Varoufakis, Greece’s former finance minister has published his views on why Bitcoin is unfit to replace fiat money. He did in a reply to Ben Arc on Monday, 27th July, 2020. He started by giving his enthusiastic views on the blockchain technology on which bitcoin operates. But he stressed how he hasn’t been fascinated by any of Bitcoin’s ability. –

“I remain enthusiastic on blockchain’s capabilities and as unimpressed by Bitcoin’s ability to help us either civilize or (as any socialist dreams of) transcend capitalism.”

Varoufakis proceeded in his letter to Ben by saying that Bitcoin lacks necessary mechanisms to stop capitalist crises from resulting to “depressions that benefit only the ultra-light”. He included that bitcoin is community based; democratic protocols will do almost insignificantly to “democratize” economic life.

Bitcoin lacks necessary shock absorbers

He argued that bitcoin lacked some necessary shock absorbers to react to certain economic situations. While citing the example of the 2008 crisis and the recent Covid-19 crisis, he underscored the importance of central banks as they had the ability to produce trillions of dollars, euros, pounds, yen among others. On the other hand, bitcoin users will not agree to the massive increase in the supply – since it will devalue their holdings. Bitcoin supply is limited to just 21 million.

Yanis went on to say nothing will make the bitcoin community agree to increasing the supply as they will probably succumb to the “Prisoner’s dilemma”. He explained that bitcoin ownership is unevenly distributed and the “bitcoin rich” will have the leverage of restricting money supply (if bitcoin replaces Fiat money) supply since it would boost their holdings at the expense of the public.

Bitcoin will not democratize economic life

Yanis based his second argument on the fact that bitcoin will not democratize economic life. He argued that the only that will change if peradventure bitcoin replaces fiat money is that Central bank will cease to exist and money supply power will be subject to bitcoin users. He included that Jeff Bezos will still retain his capitalist power amongst others at the firm level as bitcoin will fail to “democratize capitalism”.

He went on to make it clear that depression is imminent and the crisis in the first argument is bound to happen when Central banks cease to exist. –

“in short, not only will the democratization of money via bitcoin fail to democratize capitalism but it will also give an almighty boost to the forces of regression”

Yanis summarized the letter by comparing the monetary system to a dog’s tail that can’t “wag the capitalist dog” by itself. He included that replacing fiat with bitcoin with take us back to the modern version of the 19th century America in which private bankers funded private individuals that were referred to as Robber Barons during the era. Democratizing money by that means of monetary commons will only make capitalism uglier, nastier and more dangerous for humanity, he said.

He concluded by saying – “a monetary common (that may very well rely on something like the blockchain underpinning bitcoin) will, I have no doubt, be an essential aspect of a democratized economy; of socialism”.

But can blockchain be isolated from bitcoin?