Education

Uniswap V4: What you need to know

Uniswap has undergone multiple iterations, with each version bringing forth enhancements and novel functionalities.

In its initial release, Uniswap V1 facilitated token swaps between ERC-20 tokens and ETH or ERC-20 to ERC-20 requiring two separate swaps. Building upon its success, Uniswap V2 expanded the horizon by allowing users to establish pairs between any ERC-20 tokens using the Uniswap contracts. With the arrival of Uniswap V3, further advancements were made, empowering liquidity providers to contribute assets within specific price ranges.

Now, after successfully operating for five years, Uniswap has exciting news to share: the highly anticipated release of Uniswap V4 is just around the corner.

Here’s what you need to know about Uniswap V4.

Features of Uniswap V4

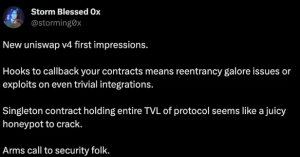

- Hooks: One of the new features in Uni v4 is hooks. Hooks are programmable buttons that developers can customize to add new features to their liquidity pools. These are familiar to users of ERC1155, ERC777, and other ERCs with callbacks: they allow for actions before or after swaps, they allow for pool customization and the implementation of dynamic swap fees, trading limits, and more. Hooks also enable the integration of Uniswap liquidity with other protocols to earn additional yield.

- Singleton Contract: Uniswap V4 introduces a singleton contract that manages all token pairs within the protocol. This significantly improves gas efficiency and reduces the cost of deploying new trading pairs by up to 99%. The singleton contract also incorporates a flash accounting system, reducing gas costs by performing internal transactions before settling final balances.

- Native ETH: Uniswap V4 supports direct pairs with native ETH instead of WETH (Wrapped ETH), simplifying the trading process and reducing costs. Sending native ETH makes the locker modifier for reentrancy protection more important

- Improved Developer Experience: Uniswap V4 enhances the developer experience by introducing features like ERC-1155 accounting for token management and governance updates that provide greater control over fees and settings.

Benefits of Uniswap V4

- Increased Efficiency and Flexibility: Uniswap V4 offers improved transaction routing and liquidity pool management, resulting in a more efficient trading experience and potentially increasing adoption.

- Improved Customization: Hooks allow developers to add new functionalities to liquidity pools, encouraging innovation and the creation of unique trading features. This attracts developers and expands the range of use cases within the Uniswap ecosystem.

- Gas Cost Reductions: Uniswap V4 incorporates features to reduce gas costs, such as native ETH support and flash accounting. This lowers barriers to entry, increases network throughput, and attracts more participants to the platform and the Ethereum ecosystem.

- Interoperability: Hooks and ERC-1155 accounting enhance integration with other Ethereum protocols and standards, enabling complex interactions between different DeFi protocols and generating more fees.

- Implications for Liquidity Providers: Dynamic fees managed by hook contracts give liquidity providers more control and potential for increased earnings. The introduction of withdrawal fees may discourage selling.

- Potential for New Market Strategies: Uniswap V4 introduces features like Time-Weighted Average Market Maker (TWAMM), limit orders, and dynamic fees, enabling new market strategies not possible in previous versions. These attract sophisticated traders and increase trading volume.

- Enhanced Vault Strategies and Collaborations – The inclusion of features like TWAMM, limit orders, and dynamic fees prompts users and developers to reimagine how they can leverage these advancements to their benefit and devise innovative strategies. This opens up new partnership opportunities for protocols seeking to build on top of Uniswap, fostering a fresh design landscape for V4 strategies.

- Promotes Long-Term Liquidity – By empowering liquidity providers to customize fees and potentially optimize their provided capital for higher earnings, hooks incentivize users to maintain their capital in the liquidity pools. This introduces a game-theoretical aspect, coupled with withdrawal fees, that discourages premature capital withdrawal.

Potential Drawbacks

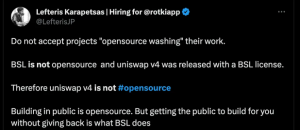

A crypto community member, Lefteris Karapetsas was quick to point out that Uniswap is not “open source” as it earlier stated. This allows Uniswap to internalize the benefits of open source (more eyes on the code) without allowing other people to profit from it.

With its licenses expiring in 2027, Uniswap V4 reflects an unfortunate trend in the crypto space to move away from truly open-sourced protocols.

There is also an assertion by @adamscochran that Uniswap is merely a replication of various other protocols.

Vulnerability issues

Governance, Release, and Distribution

Uniswap V4 will be governed by the Uniswap DAO and UNI token holders. The protocol will include a fee switch, which can be activated on a pool-by-pool basis to collect fees generated by liquidity providers.

Uniswap V4 will be released under the Business Source License 1.1, limiting usage to governance-approved entities. The release of Uniswap V4 is still pending as the code is being finalized and audited.

Concluding Thoughts

Uniswap v4 continues the evolution of Uniswap into a flexible platform for DEX innovation, with its support for the permissionless deployment of new pools that use custom “hooks.” As a liquidity provider, caution should be exercised when deploying to pools with hooks that have certain permissions, as it may lead to the possibility of losing access to your principal. However, some hooks, like hooks on swap, do not create that risk for LPs, allowing for more fearless deposits into such pools.

Uniswap v4 should make Uniswap more efficient and cheaper for users, which is great for the end consumer. The real promise of v4 is that it unlocks user innovation, and it will be exciting to see what users build.

Source:

[Uniswap V4 Whitepaper]

(https://github.com/Uniswap/v4-core/blob/main/whitepaper-v4-draft.pdf)

Read also: Uniswap Loses $25M+ to Hackers?

16 Comments