Bitcoin

What is behind the rise of BTC and ETH?

A report, by self-acclaimed Smart Money Crypto watchers, and Analysts, Lookoncxhain, revealed supposed reasons for the current increase in the price of the two most popular cryptocurrencies in the market, Bitcoin(BTC) and Ethereum (ETH).

The report, which attempted to address the sudden rise in the prices of BTC and ETH, revealed that the reason for the pump was the inflow of funds by institutions who have poured about $1.6 billion into the crypto market since Feb 10.

1/ Why did the price of $BTC/$ETH suddenly rise today?

We found that several funds/institutions poured nearly $1.6B into the crypto market since Feb 10!👇 pic.twitter.com/WRaSv4YtgP

— Lookonchain (@lookonchain) February 16, 2023

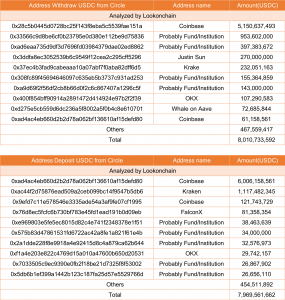

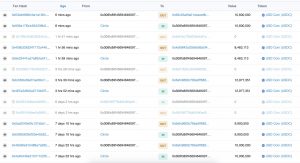

The report was based on an analysis carried out on USDC Stablecoin transactions on Circle, which involved analyzing data of USDC deposits and withdrawals from February 10th to 16th 2023.

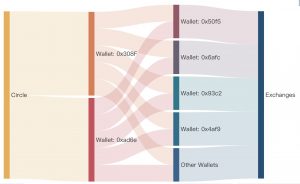

Iterating on the figure displayed below, the report claimed that several institutions and hedge funds withdrew a total of $1.6 billion USDC from Circle, and only deposited 0.2 Billion USDC.

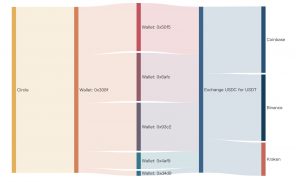

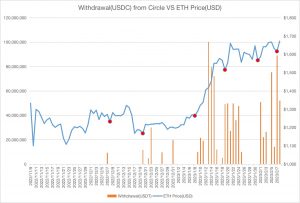

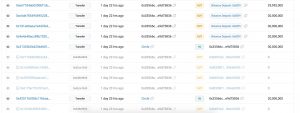

A similar report had previously highlighted a mysterious fund that started pouring money into the crypto market ahead of this year’s seeming bull run. The fund started withdrawing $USDC from #Circle on Dec 7th, 2022, and has over 10B $USDC as of 16 February, then exchanged for $USDT via 5 addresses, and deposited to exchanges.

The report claimed, Every time the fund started withdrawing $USDC from #Circle and transferring to exchanges, the price of $ETH would rise. It also appears that the rise in cryptocurrency prices has something to do with this fund.

Also, on the 1st day of February, the smart money analysts released a report, stating that a mysterious institution withdrew 31.34M $USDC from #Circle and exchanged it for $USDT, then transferred it to Coinbase, Kraken, and Binance. This report was made just 4 hours before this month’s FOMC meeting.

This institution started to withdraw $USDC from Circle and transfer to exchanges on Jan 9 and stopped on Jan 25. The report claimed It promoted the rise of cryptocurrencies such as $ETH in the past month. The fund in question withdrew 632M $USDC from #Circle and transferred to exchanges.

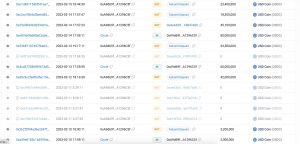

The report also claimed, it seems this mysterious fund also withdrew 397M $USDC from Circle through another address “0xad6e” and transferred to exchanges since Feb 10. Because addresses “0x308F” and “0xad6e” transferred $USDC to exchanges through the same addresses.

Another mysterious fund “0x3356” withdrew 953.6M $USDC from Circle and transferred to exchanges, as Another fund related to FalconX also withdrew 143M $USDC from Circle.

Justin Sun withdrew 190M $USDC from #Circle again. https://t.co/rFhXJpAiD1 pic.twitter.com/pXgOWHaY0Z

— Lookonchain (@lookonchain) February 15, 2023

On chain Analysis shows massive transaction volumes in and out of the major cryptocurrencies, prompting some significant massive movements. Be sure to follow CrytpoTVPLus for more narratives and news.

What do you think about this article? Comment Below

77 Comments