News

EXPLAINER: What you should know about the e-Naira

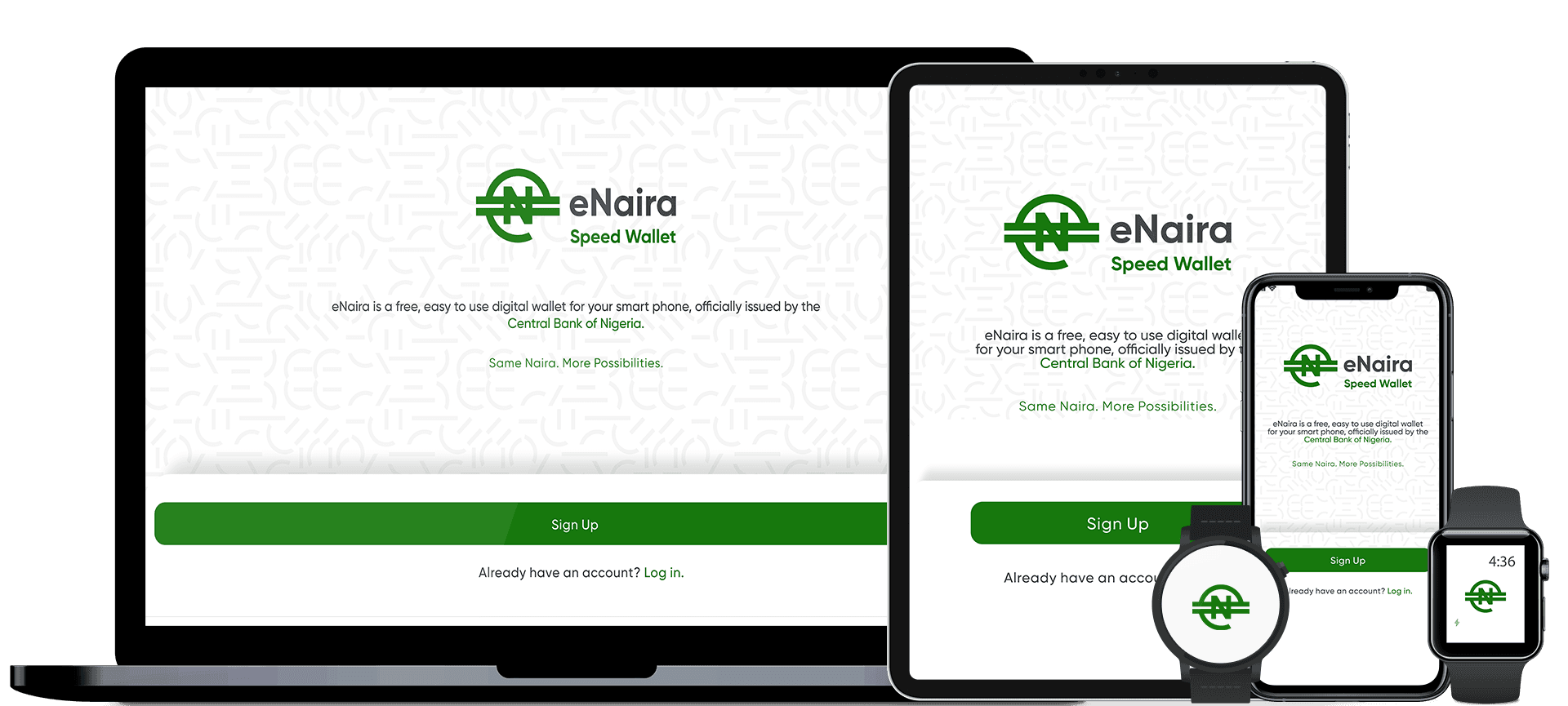

As the world adopts a new way of financial transactions, Nigeria has embraced this trend by launching its own central bank digital currency or CBDC dubbed “eNaira”. The launch which took place on Monday 25th October 2021 at the Nation’s Capital, FCT Abuja, was heralded with the rollout of two mobile applications; The eNaira Speed Wallet & The eNaira Merchant wallet.

It is imperative for everyone to have a clear & concise understanding of the eNaira and what it entails so as to leverage on its emerging infrastructure efficiently.

What is the eNaira?

The eNaira is simply a digital representation of the fiat Naira issued by the Central Bank of Nigeria. According to the CBN, The eNaira will complement the Naira; having the same exchange value and maintaining a ‘parity of value’ with the Naira. The eNaira will not earn any interest to its holders. The eNaira is built on a private blockchain, Hyperledger Fabric, with the CBN maintaining absolute control over transactions.

There are five (5) stages in the pilot launch of the eNaira, as revealed by the CBN, prior to its botched launch on the 1st of October.

The Five Stages of the eNaira Launch:

STAGE 1: For this stage, the CBN revealed that it would be responsible for issuing, distribution, redeeming & destroying the eNaira. The CBN will also maintain control, monitor & analyze eNaira transactions.

STAGE 2: At this stage, Licensed Financial Institutions such as Banks will manage & issue the eNaira across its branches. For speculative purposes, it is vital to point out that the eNaira will have a stable rate and will be equal to the prevailing Dollar rate. Banks will also handle the Onboarding of customers, KYC (Know Your Customer) & Identity compliance, distribution & promotion of the eNaira etc.

STAGE 3: Here, the Nigerian Government will efficiently process digital payments sent to and received from citizens and businesses, as well as analyze transactions and reconcile accounts.

STAGE 4: Merchants will provide low-cost solutions to manage payments such as POS and online payments, as well as analyze transactions and reconcile accounts.

STAGE 5: At this stage, Retail consumers will focus on the customer-centric design of the eNaira for good User Experience (UX). What this means is that the core focus will be on how the eNaira will work efficiently for its users. They will also work on advancing the privacy & security features of the eNaira.

Now that we have explained the launch stages of the eNaira, its important for us to have a look at the Consumer Wallet Tier Structure (or simply put, eNaira wallet features), There are primarily four (4) Tiers of the speed wallet.

e-Naira Wallet Tier Structure:

Tier 1: This is the basic tier whereby a user without a bank account can carry out financial transactions on the speed wallet app. The minimum requirement is a phone number and it must be validated with a National Identification Number (NIN), while the maximum requirements include Passport photograph, Name, Place & Date of Birth, Gender, Address. The daily transaction limit for this tier is N50,000, while the daily total balance on the wallet will not exceed N300,000.

One of the benefits of the eNaira as stipulated by the CBN is to foster financial inclusion by banking the ‘unbanked’, this is the primary reason for the Tier 1 structure of the speed wallet.

Tier 2: At this level, an existing bank account is required to access the wallet, with all the Tier 1 requirements in addition to a Bank Verification Number (BVN). The daily transaction limit for this tier is N200,000, while the daily total balance will not exceed N500,000.

Tier 3: All the requirements for Tier 2 are needed at this level, plus full KYC (Know Your Customer) in line with the CBN AML (Anti-Money Laundering) Regulations. The daily transaction limit is N1,000,000 and a daily total balance of N5,000,000.

Tier 4 (Merchant): At this final level, Merchants must meet all the requirements in Tier 3, with a daily transaction limit of N1,000,000 and a daily total balance that is unlimited.

Both the eNaira Speed Wallet & The eNaira Merchant wallet can be downloaded from the Play Store & App store.

Read More:

Now you may ask…

Why should you use the e-Naira?

The e-Naira has a low-cost advantage when compared to Naira. The daily transfers between accounts come at a no cost to the account holder(s). Lower or zero transaction cost is a massive incentive as users & merchants will pay no fees for withdrawals and deposits to and from their bank account (according to the CBN, this is only free for a period of 90 days).

How will the e-Naira help the ‘unbanked’?

The e-Naira will also bring in the vast majority of Nigerians who have no bank account but have a phone into the formal financial economy. With the e-Naira, payment of salaries, goods and services can be included. For instance, A plumber can accept payments on his phone, store them in his wallet, and make transactions with any vendor swiftly & easily.

What are the risks?

The most prominent underlying risk factor is Data security. The e-Naira is online, the BVN and NIN database is also online. With this in mind, the risk of malicious actors trying to hack or exploit the e-Naira is high. The process of minting and burning eNaira tokens by the CBN has to be top-notch and void of loopholes.

To wrap it up, the e-Naira is a milestone achievement for the Nigerian economy. It’s a positive progression towards a cashless society, with improved financial inclusion, enhanced remittance inflows and efficient cross-border trade. Nevertheless, the e-Naira will have to live up to expectations as the whole nation awaits…

What do you think about this post? Share your comments below…

Pingback: EXPLAINER: What you should know about the e-Naira by Bobby Anyadike – CryptoTvplus Events: NFT, DeFi, Bitcoin, Ethereum, Altcoin Events