News

Ethereum’s relentless determination shines through in Q2

The financial strength of Ethereum is increasingly evaluated in terms of the Ethereum ecosystem. Layer 2 rollups are an integral part of the Ethereum ecosystem, offering scalability and efficiency improvements. Some notable Layer 2 solutions for Ethereum include Arbitrum, Optimism, Polygon zkEVM, StarkNet, and zkSync Era.

These solutions have gained widespread adoption, enabling faster and more cost-effective transactions on the Ethereum network.

In a recent report by Messari, the trends of Ethereum in Q2 2023 are discussed, shedding light on the advancements and developments within the Ethereum ecosystem during that period. The report provides valuable insights into the ongoing growth and evolution of Ethereum as a leading blockchain platform.

Market Performance

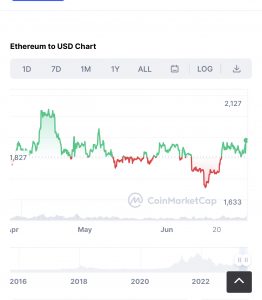

The market performance of Ethereum was somewhat inconsistent in the second quarter of 2023. Initially, the price started at USD 1,800 and experienced some upward movement, reaching USD 2,000. However, it later depreciated to an average of USD 1,700 before rebounding back to USD 2,000.

Despite this volatility, Ethereum has proven its resilience by maintaining its position as one of the leading cryptocurrencies in terms of market capitalization. It has consistently held over USD 210 billion in market capitalization.

Source: CoinMarketCap.com

Average Transaction

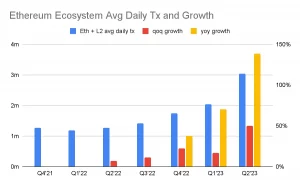

In Q2’23, the Ethereum ecosystem witnessed a significant increase in the average number of transactions processed. The figure rose from 2 million in Q1’23 to an impressive 3 million. Furthermore, the average daily transactions experienced a remarkable quarter-over-quarter growth rate of 50%, surpassing the 17% growth observed in Q1’23. It is worth noting that compared to Q2 of 2019, the Ethereum network processed an astounding 139% more transactions.

Source: artemis.xyz

NFT Ecosystem

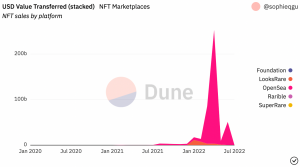

The volume of the NFT marketplace (OpenSea, Rarible, LooksRare, etc) skyrocketed by over 2,000%, surging from $509 million to $12.9 billion. This remarkable growth can be attributed to the steady expansion of the NFT ecosystem between Q2 2021 and Q2 2022, with a notable surge in the popularity of PFP collections.

As investment money poured into the NFT sector for collectibles, gaming, and art at the start of the year, crypto asset prices were affected by policy and declined. Due to this, the NFT market recorded a very high trading activity. The widespread adoption of NFTs and record Q2 transaction volumes were anticipated by many.

Source: Dune Analytics

Gross profit

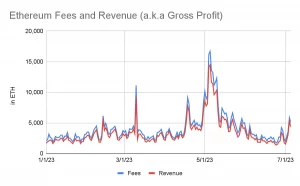

During the month of May, a significant surge occurred with regards to daily fees and gross profit, tripling their usual amounts. This remarkable increase can be attributed to the frenzy surrounding meme-coin mania, particularly fueled by the popularity of Pepe. However, following this peak, both the fees and gross profit quickly reverted back to their customary levels.

Source: artemis.xyz

The second quarter of 2023 proved to be a bustling period for Ethereum. Notable developments, increased usage of DeFi and DApps, and active community participation characterized this time. Despite market volatility and regulatory challenges, Ethereum has remained the frontrunner among blockchain platforms. The platform’s continuous growth and improvement only reinforce its potential to revolutionize the global decentralized ecosystem.

Read also: XRPL Demonstrates Resilience Amid Evolving Crypto Landscape in Q2

What do you think of this article? Share your thoughts below