News

1inch Dominates Q2 2023: Surging User Base and Market Domination

The 1inch Network, a decentralized finance (DeFi) protocol, has been making waves in the world of cryptocurrency. Since its launch in 2019, the network has expanded its offerings, extending its reach across various chains like Ethereum, Arbitrum, Optimism, Polygon, and many more.

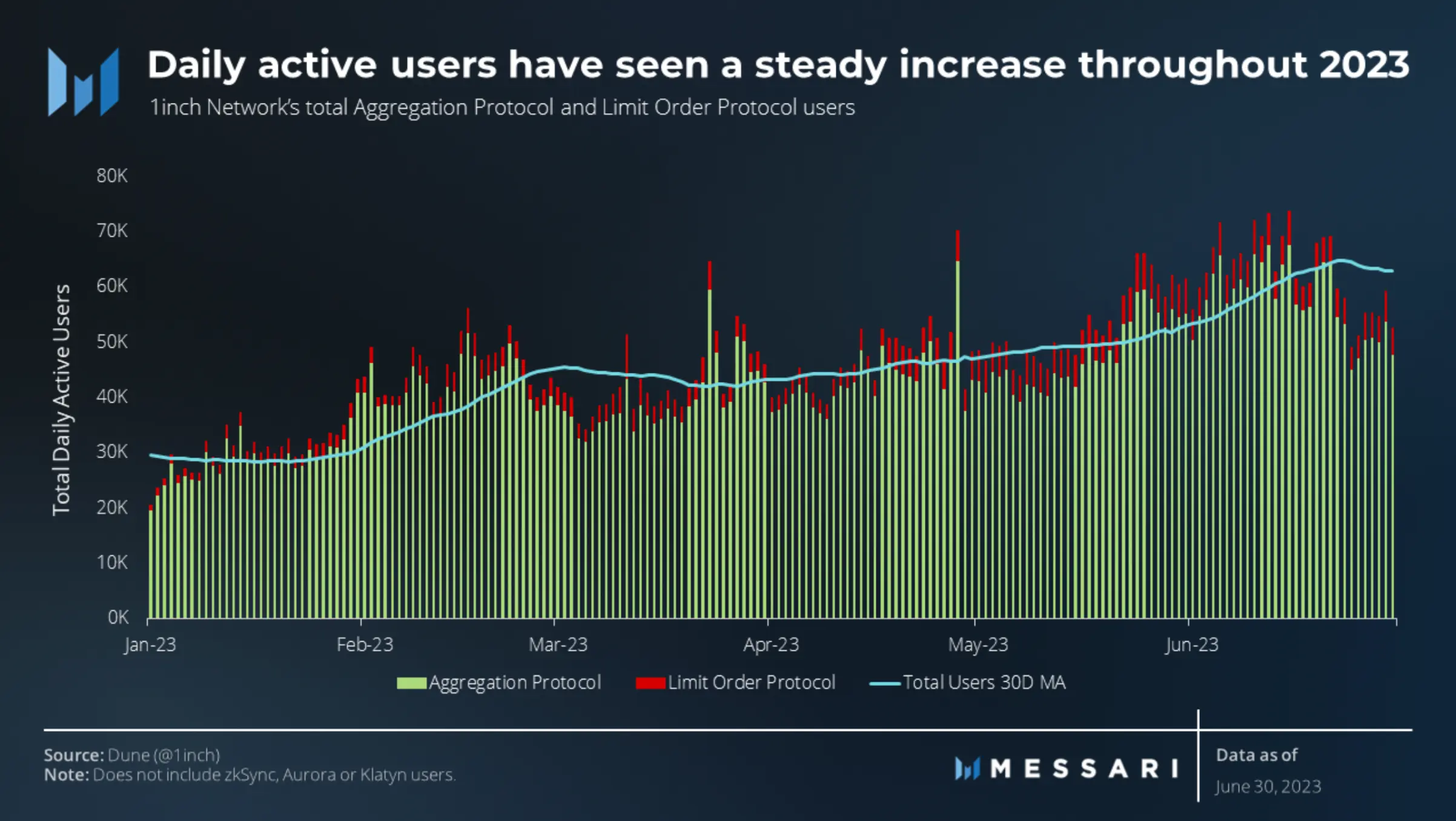

An in-depth analysis of user data sheds light on the remarkable progress made by the 1-inch Network in the second quarter of 2023. The network witnessed significant growth in its user base and solidified its position in the market.

Remarkably, the adoption of 1-inch Network Aggregation and Limit Order protocols has skyrocketed. The Aggregation Protocol alone saw an impressive rise from 3.3 million users in Q1 to 4.5 million users in Q2. This signifies a noteworthy surge in user engagement. Similarly, the Limit Order Protocol experienced remarkable growth, with the user base surging from 261,000 users to 438,000 users—a remarkable 68% quarter-over-quarter increase that cannot be ignored.

In Q2, Ethereum maintained its position as the “whale chain” with an average trade size of $31,000. The spikes in trade size were driven by the Shanghai upgrade and ETH staking withdrawals, indicating increased activity and user engagement.

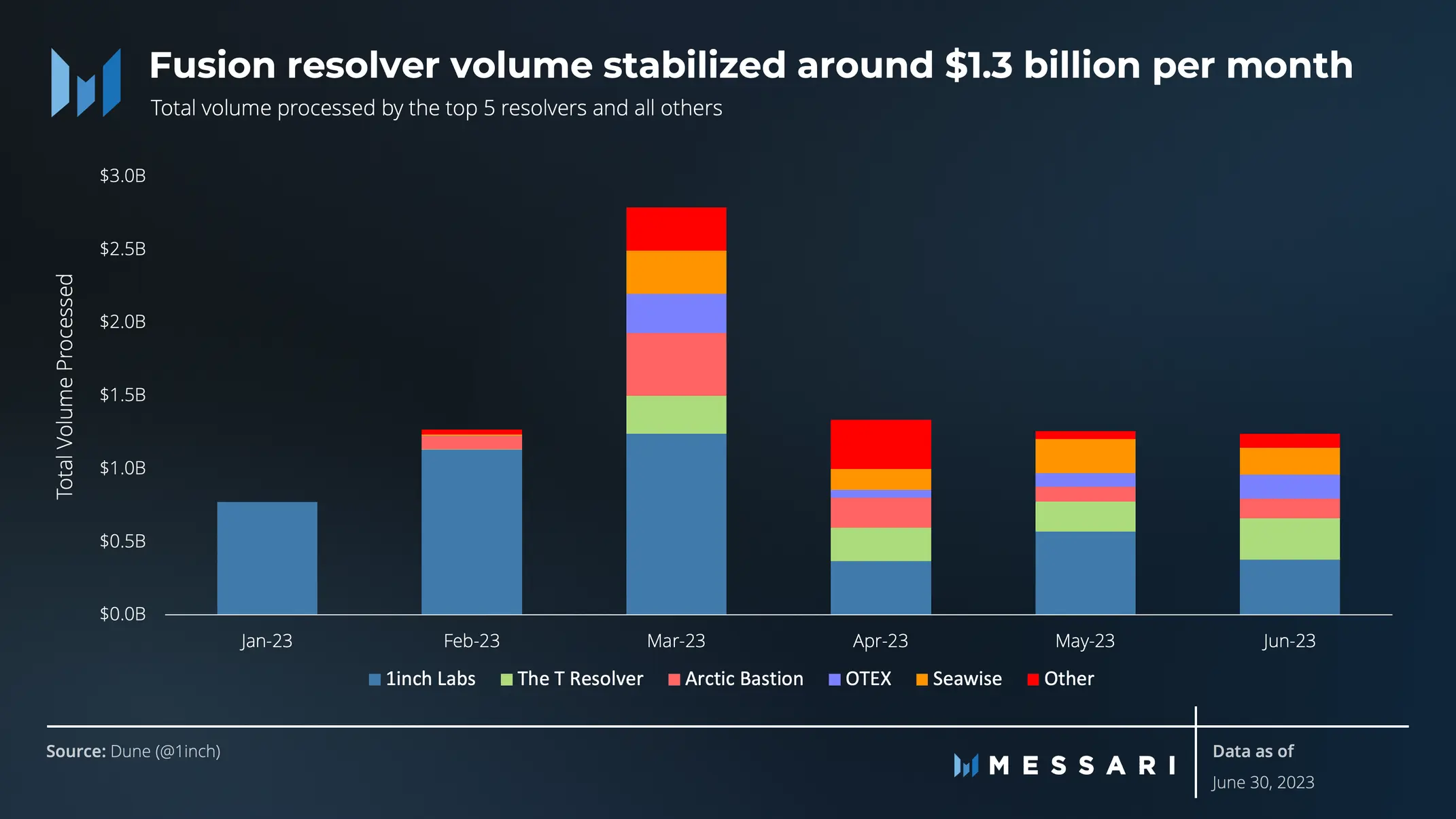

The 1-inch Network played a prominent role in the DeFi market, processing over $28 billion in total volume during the quarter. While there was a 37% decrease compared to Q1, this can be attributed to inflated volumes resulting from the USDC depeg event. When adjusted for this event, the decrease narrows to only 19%, reflecting consistent performance.

A notable shift occurred in Q2, with “Other” DEXs accounting for 44% of the total volume, signaling a diversification in volume distribution.

Q2 also saw the introduction of Fusion Mode, a feature that enables users to place orders without paying network fees. This innovation facilitated over $3.8 billion in transactions through Fusion Resolvers, providing cost-effective solutions and enhancing the user experience.

Market share analysis reveals an interesting trend: while competitors saw shifts in their market share, 1inch maintained its dominant position among aggregators in Q2. Accounting for a significant 49% of all direct-user volume share, 1inch stood out as the top choice for users seeking efficient DeFi services. This consistent performance demonstrates the trust and preference users have in 1inch as their go-to aggregator.

Aggregation Protocol

The Aggregation Protocol of the 1-inch Network maintained a significant share of the total trade volume, representing 81% across both protocols. Ethereum remained the dominant chain, contributing 70% of the total aggregation volume. However, Ethereum’s dominance decreased from 81% in January to 71% in June, indicating a trend towards more cost-effective networks as they mature.

Treasury Analysis

During Q2, the 1inch DAO treasury experienced a decline of 10.8%, reaching $16.3 million by the end of the quarter. This decrease can be attributed to several factors, such as the approval of funds for completing the production of the 1-inch Hardware Wallet and the implementation of the 1-inch Community Builders Program. Additionally, the discontinuation of swap surplus collection, which used to be a significant revenue source for the DAO, also played a role in the decline. In response, the DAO actively explored alternative revenue avenues, including depositing funds into AAVE V3 to generate passive yields.

Staking Analysis

In Q2, the staking initiatives of 1inch Network experienced significant growth. The 1INCH V2 staking saw an impressive increase of over 20%, resulting in a total of 184 million staked 1INCH by the end of the quarter. Staking incentives, such as Unicorn Power accumulation for voting and delegation, played a pivotal role in driving this growth. However, there was a slight decline in staking inflows during May, which coincided with a broader downturn in the crypto ecosystem. Fortunately, June witnessed a rebound with 29.3 million staked.

During Q2, the governance structure of the 1-inch Network underwent several changes. Voting parameter adjustments were implemented, replacing st1inch (V1) with st1INCH (V2) and introducing Unicorn Power for voting and delegation. Additionally, a Recognized Delegates Program was established to create paid positions for qualified DAO members who contribute to the growth of 1 inch. These updates aimed to streamline governance processes and improve efficiency.

Notable Developments

The second quarter brought notable developments for the 1inch Network. The 1inch Hardware Wallet successfully secured funding to complete its production, offering unique features and enhancing user security. The 1inch Community Builders Program also received overwhelming support, with funds allocated to boost brand awareness and community engagement. Furthermore, the deployment of 1inch on zkSync Era, a Layer-2 scaling solution, resulted in increased volumes for the network’s products.

Closing Thoughts

Despite facing challenges and undergoing changes, the 1inch Network exhibited remarkable resilience and continued its development throughout Q2 2023. A treasury analysis revealed a reduction in funds due to various circumstances, prompting the DAO to explore additional revenue streams. Staking ventures experienced substantial growth thanks to incentives and the accumulation of Unicorn Power. Governance updates aimed to streamline decision-making processes, while general updates celebrated significant milestones such as the introduction of the 1inch Hardware Wallet and strategic community-building initiatives. All in all, the 1inch Network demonstrated adaptability and perseverance in the ever-evolving DeFi landscape.