Education

Messari Report: Top 10 Cryptocurrency Trends in 2022

2022 in retrospect, the Messari report for 2023 gave a preview of 2022. Several issues were raised and discussed at length in the report. Taking up one of those issues, this article seeks to examine the top 10 cryptocurrency trends in 2022.

Bitcoin is “Outside Money”

One of Messari’s macro analysts to read and follow is Zoltan Poszar of Credit Suisse. Although his investments don’t always pan out, Messari opined that any serious investor should read his conceptual models and frameworks for approaching the world’s leading reserve currencies. In contrast to what those who have been involved with bitcoin since its inception have been able to come up with, Zoltan popularized the term “outside money,” which is a more elegant descriptor for non-sovereign currencies.

For the cryptocurrency industry, it was a “cross the Rubicon” moment when the U.S. decided to penalize Russia for its invasion of Ukraine and, more crucially, to confiscate its U.S. Treasury holdings. The Bretton Woods III, as Zoltan referred to it.

Deglobalization, domestic supply chains, and commodity reserves all have the potential to lead to chronic inflation, according to Zoltan. In place of G7 “inside money” and foreign exchange reserves that gradually lose purchasing power, nations outside the U.S.-EU alliance will “inevitably, but not imminently” turn to outer money like gold and other commodities.

Global Regulatory Authorities

According to Messari’s research, it’s unlikely that international authorities will appreciate innovations that make their work more difficult. This has nothing to do with the anonymity of bitcoin (crypto is notoriously easy to track with forensic tools like Chainalysis). However, due to how difficult it is to freeze or confiscate Bitcoin on a large scale.

Because of this, despite the fact that the data indicates otherwise, Bitcoin is frequently criticized as a tool for terrorists, money launderers, and rogue nations. Drawing attention to the anomalies and unfavourable examples might be politically wise, especially when government-affiliated financial experts challenge those claims with verifiable facts. They certainly never applaud the technology when its similar features enable refugees in nations racked by war to raise money when they’re in need or for individuals to maintain their financial stability during a complete currency collapse, such as the terrible situation that exists in Lebanon right now.

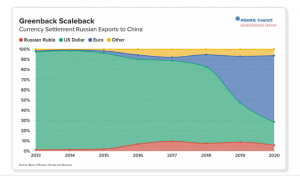

For example, the Treasury Department was aware that there was no practical chance that Russia could use cryptocurrencies to meaningfully avoid sanctions. For bitcoin to accomplish that, there would need to be financial flows that are several orders of magnitude higher than what would be concealable on a public ledger like bitcoin. Russia will almost surely use digital assets to circumvent American sanctions, but given current patterns, it appears more likely to be the digital yuan.

That didn’t stop regulators from using bitcoin as a red herring, denouncing it as a possible Russian instrument at the time and afterwards as justification for an unnecessary, overreaching bill to ban cryptocurrency in the name of “security.” Similar things happened when the Canadian government put American CEOs on a watch list for advocating self-hosted cryptocurrency wallets: a thuggish response to foreigners’ protected internet speech.

All of these factors contributed to the rise of the regulation of cryptocurrency in 2022.

Bitcoin Mining

For miners, 2022 hasn’t been a particularly nice year. The price of bitcoin traded at $60k a year ago, and Texas-based bitcoin miners could create it for $5,000–10,000. Today, mining the same amount of bitcoin costs more like $15,000–20,000, and more miners are struggling.

Messari discussed the “good facts” and “bad facts” regarding proof-of-work mining and if bitcoin may genuinely help better the environment while examining the regulatory crosshairs in which Bitcoin mining stands.

Bad Facts

- Each year, the amount of e-waste produced by bitcoin mining is comparable to that of a nation the size of the Netherlands. Currently, only 17% of this type of garbage is recycled.

- Bitcoin mining can be construed to have played a role in the increased marginal energy costs for the typical user in areas with severe energy shortagess and high costs.

- Only 39% of mining bitcoin at the beginning of the year was renewable. According to CoinShares, coal and gas provide close to 60% of the computing power used to mine bitcoins.

Good Facts

- Market forces have fixed and capped the cost of bitcoin mining. Even if more people use bitcoin, it doesn’t become somewhat more energy-intensive. Instead, it depends on the market capitalization of bitcoin and energy prices. Energy use and electronic waste will be constrained by the marginal cost of mining one bitcoin for the next five to ten years. This cost will only increase if bitcoin’s total market value rises. (You wouldn’t purchase more energy than mining BTC is worth.

- The carbon footprint of mining nowadays is comparable to that of tumble dryers and is only about a third of that of gold mining. Additionally, it uses a lot less energy than the world’s financial system or the armies that protect it. Not quite a world killer as tagged.

- The “dung beetles” of the energy sector are bitcoin miners, to sum up. The energy that nobody else wants or can utilize will be consumed by them. The use of stranded and wasted energy sources is still on the rise. More and more bitcoin miners are collaborating to collect waste materials like recycled tires, stranded geothermal energy, and coal ash.

The White House Office of Science and Technology commented favourably in their report on the crypto economy, making it a very relevant component to draw attention to.

Bitcoin Yield

Since Bitcoin cannot be staked, lending it to centralized counterparties is not a good idea, as recent experience has demonstrated. What if, however, there was a way to create bitcoin yield directly without taking on counterparty risk? Messari wrote on this earlier this year, which can be leveraged by nations and businesses that might otherwise be sitting on huge BTC reserves. Everything comes down to a wager on the Lightning Network, something which might prove to be unyielding. About $90 million is currently available for lightning. The size of Wrapped Bitcoin on Ethereum (WBTC), which is 40 times greater, is 10% of the TVL in DeFi apps.

Few corporate treasurers are eager to stock up on bitcoin when interest rates are rising. The likelihood of supply-side shocks coming from miners covering costs and debt service payments, tax loss harvesting, and (in highly negative situations) probable default-driven sales from Microstrategy is higher. The next demand-side shock for bitcoin is expected to occur at the level of the global government, not large enterprises, barring a dramatic Fed pivot on interest rate policy.

The fact that Bitcoin cannot be staked has raised eyebrows in the last year which made it a trend.

Memes and Ripples

The top three performers in Q4 among the top 25 cryptocurrencies by market cap were Dogecoin, Litecoin, and Ripple’s XRP.

The ongoing Ripple court case could also be responsible for this.

These will spring up different reactions among the blockchain populace which made it a trend.

Privacy coins and Private Transactions

Blockchains like Ethereum support the processing of private or “shielded” transactions in particular pools and are transparent by default. But it’s unclear if that will ultimately turn out to be a feature or a bug on a large scale.

On the bright side, if they had been private from the beginning, Messari is not convinced the crypto space would have been able to scale public blockchains under real-world regulatory restrictions. The crypto space has profited immensely from default public and pseudonymous chains in terms of audibility and transaction monitoring.

There was less anxiety at the space since those who track illegal funding for a living had a slightly easier job.

On the other hand, “privacy preservation tech” has now been classified as bad for crypto applications due to the default public nature of the majority of blockchains. In the future years, the crypto space will need a significant increase in public support and acceptability to fend against authorities. Applications like Tornado Cash will continue to be at risk of being accused of “aiding and abetting money laundering” if this doesn’t change.

In the paper, Messari dropped hints about potential solutions, saying that in developing them, opportunities would be available for the two largest networks that are private by default, Monero and Zcash, as well as privacy-focused Layer-2 scaling alternatives like Aztec and Polygon’s Nightfall. In light of the impending privacy wars, Messari also stated his optimism for both Zcash and Monero.

Stablecoins should be our leading Export

With the U.S. dollar still reigning supreme as the world’s reserve currency, Mesasri believes adopting stablecoins as a national priority would provide an almost insurmountable distribution advantage.

The DeFi buildout and crypto infrastructure are being driven by entrepreneurs. Today, more than 50 million Americans own cryptocurrency, and most of the total amount of crypto in circulation may be owned by Americans. Given that open financial architecture is fundamentally incompatible with Beijing’s totalitarian regime, the cryptocurrency industry is another industry in which China just cannot compete.

In countries with sky-high inflation, such as Argentina, where a dozen contradictory exchange rates overlap and the government is enacting new regulations about who can access dollars, there is an urgent demand for USD-pegged stablecoins.

According to Messari, if the US wants to maintain its position as the world’s reserve currency, it must improve its ability to export digital dollars free of the CBDC’s restrictions because no other government will desire it on the grounds of national security and privacy.

Furthermore, Messari argued that many nations wish to escape the dollar’s hegemony but that the US shouldn’t facilitate this by lagging in technological advancement and regulatory frameworks.

The Stablecoin Trinity

Messari explained this by giving the classification of the different types of collateralized stablecoins.

- The Majors: According to Messari, Circle and Paxos are the two well-governed US-based stablecoin issuers. Blackrock and BNY Mellon are two of Circle’s custodians, and the company has $45 billion in USDC. The Binance USD stablecoin and Paxos dollar, both of which are issued by Paxos, have a total market cap of around $20 billion, of which 95% is BUSD. While Circle is a registered money transmitter, Paxos is governed as a trusted business by the New York State Department of Financial Services.

Although USDC is the most popular Ethereum-based stablecoin and DeFi reserve, Paxos is “better regulated” and has the largest worldwide exchange (as well as Mastercard and PayPal) as white-label customers. However, it occasionally encounters FUD.

- The Cowboy: Over the previous few years, Tether’s market dominance has been eroding year after year. This year, in particular, BUSD and USDC have eaten into its ETH-based market share. Due to Tether’s dominance on the Tron blockchain, USDT still has a 50% higher market cap than Bitcoin, but it has otherwise lost ground. The dominant “not quite U.S.-blessed” digital eurodollar, USDT on Tron is primarily a global phenomenon.

The duo mentioned above is collateralized and pegged to a physical asset. Some stablecoins are pegged and collateralized by cryptocurrencies. They are:

- Dai: Despite a roughly 50% decline in circulation from its peak in March 2022 to $5 billion, it has once again displayed tenacity during a harsh bear market. MakerDAO and Dai have not encountered any major problems or destabilization of the Dai peg despite the frequent shocks in the centralized crypto lending markets.

- Other: Despite having similar structures to Dai, the majority of the other crypto-collateralized stablecoins, such as Liquity’s LUSD (and soon-to-be-competitive stablecoins from Aave and Curve), are rounding errors in comparison to Dai. The only algorithmic stablecoin team still in existence, Frax, is the only other significant crypto-collateralized stablecoin.

Algo-Stables: Crypto’s WMDs

The failure of Terra in 2022, along with its LUNA token and TerraUSD stablecoin, came quickly and brutally. Investors suffered great agony, and many people who had invested in Terra’s UST lost their whole life savings, either directly or indirectly. It’s reasonable to wonder if the crypto populace should keep performing these risky algorithmic stablecoin experiments or whether they are all eventually destined to suffer the same excruciating demise.

Messari claims that the crypto populace is fortunate that Terra collapsed before it grew larger and completely disabled DeFi. Both Hayes Arthur’s and Matt Levine’s explanations of LUNA are excellent supplements.

These seigniorage share structures are meant to separate risk into a stable asset that is the target of stabilization and a speculative asset that absorbs volatility and backstops the system. However, they are reflexive in down markets, which spur “bank runs” and presumptions about “lenders of last resort” to support the share token in trying times.

Messari expresses confidence in the seigniorage share concept but cautions that the developers should proceed cautiously and use an “insurance” contract supported by trading and lending fees (like BitMEX). Through an example, Messari demonstrated how Terra could have had a chance to stop a bank run if they had been able to use fees from their payment partner Chai or net interest margin from the sister lending system Anchor and put those funds into an insurance fund.

However, the unit economics and risk guardrails vanished along with the cautious, fee-driven expansion. They had terrible capital ratios, and this is basic banking information.

CBDCs and Dystopia

2022 saw an increase in the adoption of CBDCs. A lot of countries launched their CBDC while some have put plans in motion. Plans that will materialize in 2023.

The CBDC craze, according to Circle’s Head of Policy, Dante Disparte, truly got started with Libra. They weren’t upset with Facebook’s audacity. They desired it for themselves out of jealousy over its potential. “

To fully comprehend Dante’s stance, refer to this comparison table.

Messari outlines two lines that best describe CBDCs for “those incapable of squinting”:

- The argument for CBDCs is sometimes presented as a solution for banking system flaws that may be resolved with policy and rules-based competition instead of taxpayer-borne financial science experiments.

- A CBDC would be the same as having the Federal Aviation Administration define competitive, rules-based safe passage in the sky rather than flying planes and manufacturing jet engines.

Read also;

Pingback: Barry Silbert given deadline to Genesis's withdrawal solution; denies borrowing | CryptoTvplus: DeFi, NFT, Bitcoin, Ethereum Altcoin, Cryptocurrency & Blockchain News, Interviews, Research, Shows