News

With 160,000 Partners, Coinbase Nets $2 Billion Revenue in Q2

US based cryptocurrency exchange Coinbase has reported a $2 billion net revenue for the second quarter of the year.

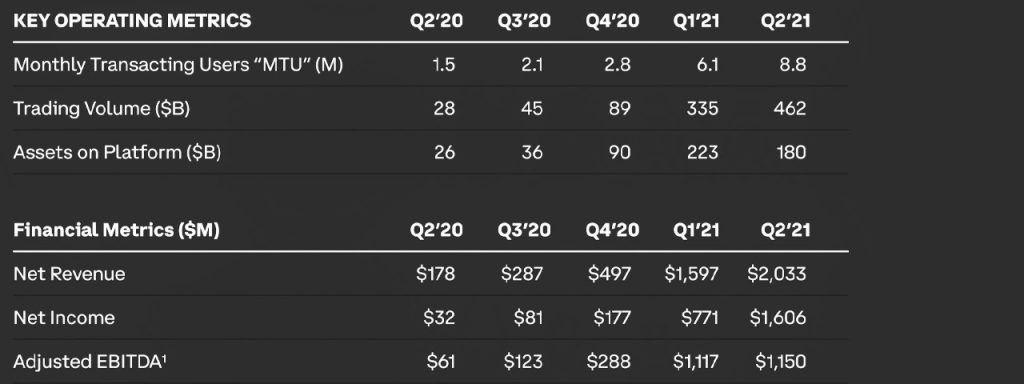

The company published a report detailing its financial statements. According to the document, Coinbase financial metrics showed a $2.033 billion net revenue with a better income of 1.606 billion dollars.

It’s retail monthly users saw a 44% growth to 8.8 million.

Compared to Q2, 2020, Coinbase trading volume by 16.5 times from $28billion to $462 billion. It’s assets on the platform also grew from $26b in Q2, 2020 to $180bn in Q2, 2021. Though this was higher in Q1, 2021.

Read also: See how this hacker after draining Polychain of over $600m, decides to return funds

Other notable growth are the monthly users which went from 1.5m in Q2, 2020 to 8.8m in Q2, 2021 and it’s Adjustable EBITDA which saw a huge increase of $61m in Q2, 2020 to $1.15 billion in Q2, 2021.

Coinbase Growth in institutional business and partners

Coinbase revealed it currently has over 9,000 institutional users and 160,000 industry partners. These partners includes

firms such as SpaceX, Tesla, PNC Bank, Wisdomtree and Third Point LLC including Elon Musk himself.

Read also: Bank of Ghana Partners with G+D to Pilot its Central Bank Digital Currency

According to Coinbase institutions are choosing it because of “the deep pools of liquidity we offer, our sophisticated algorithmic order execution, as well as the trust that comes with being a public company”

Coinbase asset trading volume analysis

The document published showed that Ethereum’s Ether held a 26% market dominance on the platform. Bitcoin (BTC) held a 24% dominance in trading volume in Q2. Other cryptocurrencies together hold 50%

Most of the trading on the platform came from Institutional businesses with them having a $317 billion trading volume compared to retail traders who commanded a $145 billion in Trade Volumes.

What do you think of this story? Shaee your comments below

Pingback: AFEN to Launch NFT Marketplace in August and AFROXNFT Project | CryptoTvplus: DeFi, NFT, Bitcoin, Ethereum Altcoin, Cryptocurrency & Blockchain News, Interviews, Research, Shows