News

The Nigerian SEC has issued a statement on Inksnation, calls it illegal.

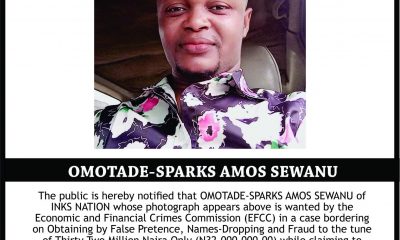

The securities and exchange commission of Nigeria SEC has issued a statement on IBSmartify, the creator the Inksnation alleged blockchain based decentralized autonomous organization. The SEC in its statement advised the general public to beware of the illegal of the product and the company promoter(s).

In its statement, SEC said “The attention of the commission has been drawn to the activities of IBSmartify Nigerian, the promoters of a blockchain known as iBledger (Bcashcryptocurrency) and Inksnation. The general public advised that neither the promoters of iBsmartify Nigerian nor the illegal products they offer are registered or regulated by the Commission.

In view of the above, the general public is hereby WARNED that any person dealing with the said entity and others in the same business in any manner whatsoever, does so at his/her own risk.”

It will be recalled that some months ago, IBSmartify wrote an open letter to the EFCC claiming they will use the blockchain technology to eradicate poverty from Nigeria. Over the months, with that vision, the Inksnation has been seeing growth around the country with over 45,000 members on its telegram group.

In June 2020, crypto self regulatory body, Stakeholders in Blockchain Association of Nigeria – SiBAN issued a public statement calling out the activities of the promoters and operator of Inksnation.

Inksnation seeks to pay investors who put in money with the least being N1,000 as from August 12th. The least investors who join in with N1000 will be paid a monthly salary of N120,000 called iBsalary.

In the Mid of the month of June 2020, in an AMA organized by founder of LightBlocks with the founder of Inksnation, Inksnation founder known and called by those in his community as UDI (Universal Daddy Ink) make it clearly obvious that the product he was selling has no basic economic structure or a sound technical architecture to be called a blockchain after he was asked series of questions by some of the industry leaders in the Nigerian blockchain community.

In the AMA, UDI revealed the primary driver for the project. According to him, he claimed God spoke to him and asked if He eradicates poverty, will the people serve him? This religious attachment presents a unique and fascinating subject of discuss.

After the AMA, UDI published a vacancy for some unique positions which further defined the type of enterprise he is running. The vacancies are for the position of UI/UX designers, Legal Personnel, Web & App Core Developers, Blockchain Core Developers, Content Writers with Blockchain knowledge. The job required interested parties to relocate to Lagos, Nigeria.

With August 12 not far away into the future and the determined zeal of UDI and the thousands of followers of his vision, while the world watches and regulators take up the fence position, a potential volcanic eruption may be on the horizon.

Pingback: Ponzi schemes are truly a big problem for our economy, SEC Cries out | CryptoTvplus: DeFi, NFT, Bitcoin, Ethereum Altcoin, Cryptocurrency & Blockchain News, Interviews, Research, Shows