News

Naver and Dunamu in talks to acquire South Korea’s Upbit exchange

South Korea’s financial markets are buzzing after confirmation that Naver Financial, the fintech arm of Naver Corp., is in active talks with Dunamu Inc., operator of the country’s largest crypto platform, Upbit crypto exchange.

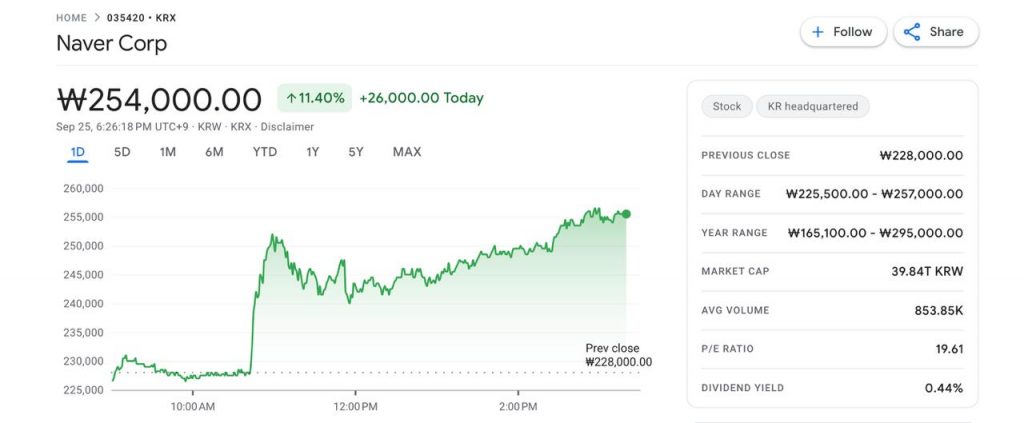

The disclosure came after a dramatic 11 percent surge in Naver’s shares, sparked by reports that the two companies are exploring a potential merger deal that could reshape the country’s digital economy.

In its filing to regulators, Naver Financial acknowledged discussions with Dunamu over a variety of possibilities, including a potential share swap merger, while making clear that no definitive agreement has yet been reached. Dunamu, in a separate message, confirmed it was examining ways to cooperate with Naver but emphasized that no finalized deal has been signed.

If completed, the Naver Financial merger with Dunamu would mark one of the most significant alliances in the history of South Korea’s fintech space. Naver Pay, one of the nation’s most widely used digital wallets, competes with Kakao Pay, Toss, and traditional banks in the booming payments sector. Pairing its user base and distribution channels with Upbit’s dominance in cryptocurrency trading would create a financial powerhouse that fuses mainstream payments with digital-asset markets.

Under the arrangement, Naver Financial would issue new shares to acquire holdings from existing Dunamu shareholders, effectively turning Dunamu into a wholly owned subsidiary. Negotiations are reportedly focused on determining the swap ratio for Dunamu’s unlisted stock according to Bloomberg. Naver Corp. already controls more than 80 percent of Naver Financial.

The timing of these discussions highlights a growing global trend where fintech companies and internet platforms seek to integrate blockchain-based payments and crypto trading features. With nearly one-third of South Korea’s population actively participating in digital asset markets, the country has become a proving ground for new financial technologies. On certain trading days, Bloomberg reports volumes on local crypto exchanges even surpass turnover on certain stock indexes.

Political momentum is also shaping the landscape. President Lee Jae Myung, who pledged to build a crypto-friendly South Korea, introduced the Digital Asset Basic Act earlier this year. The legislation aims to expand protections for investors while promoting industry innovation.

The talks also coincide with Korea Blockchain Week in Seoul, an event drawing global crypto executives, regulators, and investors. Rival exchange Bithumb recently signed a deal with World Liberty Financial, a venture linked to U.S. President Donald Trump, indicating how deeply international politics and finance now intersect with South Korea’s crypto sector.

For Naver, known for its dominant search engine and internet services, the Naver Financial merger represents an opportunity to extend its reach into digital assets. For Dunamu, whose Upbit crypto exchange is already the top trading platform in South Korea, access to Naver’s vast ecosystem could embed cryptocurrency into daily consumer activity, from mobile payments to e-commerce transactions.

In October last year, the South Korean Financial Service Commission (FSC) launched an investigation into the exchange to determine if it engaged in anti-monopoly practices. Regulators discovered over half a million KYC violations and as a result restricted the exchange from acquiring new users in February, 2025. In March however, this suspension was temporarily revoked after Dunamu took legal action against the Korean financial regulators.

The Naver Financial merger with Dunamu could set the standard for how traditional fintech services and crypto exchanges integrate, shaping not only domestic competition but also influencing the global conversation on the future of money.

Over the last 24 hours, the Upbit trading volume stands at $2.8 billion.

Pingback: 네이버-두나무, 한국 업비트 거래소 인수 논의 - 비트카지노신나

Pingback: Naver and Dunamu in talks to acquire South Korea’s Upbit exchange - Blockchain People