Education

XRPL Demonstrates Resilience Amid Evolving Crypto Landscape in Q2

The XRP Ledger made some progress in the volatile cryptocurrency market during the second quarter of 2023. The XRP Ledger has become a frontrunner among blockchain solutions by prioritizing development in three key areas: partnership growth, functionality, and security.

Partnership Growth

The XRP Ledger saw a rise in usage during the second quarter of 2023 and established vital alliances with major players like the central banks of Colombia and Montenegro and respected academic institutions like the University of Toronto. With its rise in popularity, XRP quickly became a reliable option for international transactions.

As of Q2 2023, XRP, the native token on the XRPL, had a market cap of $24.8 billion, making it the sixth-largest cryptocurrency. Although the XRPL can theoretically support up to 1,500 transactions per second, it only processes about 15 on average. The XRPL features fixed transaction fees of 10 drops for the vast majority of possible deals. At the current price of XRP ($0.47), one drop is equal to one-millionth of an XRP.

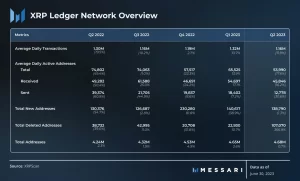

Also, XRPL saw a decrease in all of its network activity metrics. The average number of daily trades fell from 1.32 million in the previous quarter to 1.16 million in the current quarter, a level not seen since the third quarter of 2022. The number of average daily active addresses also fell, from 66,000 to 54,000, a decrease of 17.6% quarter over quarter. Although Q2 saw a record low in transactions, the number of active addresses fell to a new all-time low.

Source: Messari.io

Functionality

The XRPL’s native token, XRP, is used for a variety of purposes, including transaction fees, wallet reserves, and more. Burning XRPL transaction fees exert deflationary pressure on the total supply of 100 billion XRP. Only about 10 million XRP have been destroyed since the XRP Ledger’s inception.

All transactions on the XRPL, whether they involve fungible tokens or NFTs, are processed by a centralized limit order book. Instead of the inherent vulnerabilities of smart contracts, this DEX has fewer trust assumptions and centralized liquidity.

One of the few metrics of network activity that rose QoQ was the total number of NFT transactions. The quarterly average of NFT transactions rose from 13,800 to 15,500, representing a 12.7% increase. Compared to the previous quarter, NFTokenAcceptOffers grew at the quickest rate, increasing 25.5% from 3,100 to 3,900. Throughout Q2, the number of calls to NFTokenCreateOffers increased by more than 1,000 on average per day.

There were a total of 1.6 million XLS-20-standard NFTs issued by the end of the second quarter. With a total of 4.0 million XRP (USD 1.6 million) sold, XPUNKS remains the leader in NFT sales volume.

Source: Messari.io

Security

There are a number of XRPL sidechains available or in the works. To achieve its goal of reducing L1 complexity, the XRPL is expanding the programmability of sidechains for both generic and application-specific purposes.

Sidechains like EVM, Coreum, Root Network, and Flare Network are being secured by Proof-of-Stake (Coreum), Proof-of-Authority (EVM Sidechain) consensus mechanisms. The second quarter saw enhancements to the XLS-38d bridge and the EVM sidechain. Transfers between Issued Currencies and ERC-20s, along with a new consensus process and other features, are currently being tested by the development team.

Developments and Potential: XRP Ledger’s Ecosystem in Q2

A lot of work was done on the XRP Ledger’s ecosystem in Q2. Community adoption has not yet spread to sidechains like Coreum and Root Network that exist off of the XRPL mainnet. The reasons for this are the debuts of both Coreum and Root Network in 2023.

More users will likely join sidechains as their ecosystems mature and interest in them grows, especially as the community shows interest in adding mainnet support for NFTs via new transaction types, and ecosystem infrastructure for NFT projects.

With an average price of $0.45 in Q2, an increase from $0.4 in Q1, XRP still has a lot of of potential in the coming quarters of the year.

Read also: Spotlight on the growing crypto market in the Middle East and North Africa

What do you think of this article? Share your thoughts below