Ethereum

Is Arbitrum Pumping? See how the L2 has performed in 5 months

Arbitrum is a well-known layer 2 scalable blockchain built on the Ethereum Network. The Layer 2 blockchain describes itself as a network “designed to scale Ethereum”, with the opportunity for cheaper and faster transactions. On Arbitrum, developers could deploy smart contracts and Web3 dapps, in a cheaper and faster way than one would normally do on Ethereum.

How it works

Rollups are a type of off-chain scaling solution that allows for the processing of transactions and other data off the main blockchain, while still maintaining the security and integrity of the network

Arbitrum Optimistic rollups limit on-chain computation by performing proof of confirmation only if a node suspects that a fraudulent transaction is occurring. By performing validity proofs only when fraud is suspected, Arbitrum’s optimistic roll ups increase transaction speed and throughput even further.

Ethereum’s Layer 1 initially “optimistically assumes” activity on Arbitrum is following the proper rules when performing transactions on L1. If a violation occurs (i.e., claims of fraud or swiped funds), this claim can be disputed back on L1; and fraud will be proven or the invalid claim disregarded, and the malicious party will be financially penalized.

Arbitrum’s ability to adjudicate and prove fraud on L1 is the blockchain’s key feature, and is how and why the system inherits Ethereum’s security.

Data that gets fed into an Arbitrum Rollup chain’s data (i.e., user’s transaction data) is posted directly on Ethereum. So, as long as Ethereum itself is running securely, anybody who’s interested has visibility into what’s going on in Arbitrum and has the ability to detect and prove fraud.

The only drawback or delay is felt by a user in the area of “withdrawing” –moving funds from Arbitrum back to Ethereum; if users are withdrawing directly from Arbitrum to Ethereum, they must typically wait 1 week before receiving their funds on L1. However, the long waiting period could be bypassed entirely, If users use a fast-bridge application (likely for a small fee). Anything else a user does — i.e., depositing funds from Ethereum onto Arbitrum, or using a dapp deployed on an Arbitrum chain — doesn’t incur this delay period.

Arbitrum in the past 6 months

The last 6 months have been some of the most active on the Arbitrum Blockchain. It started 5 months ago, when the leading NFT Marketplace Opensea, announced support for the L2, a support that allowed creators to list NFTs on the Ethereum roll-up. The integration also supported NFT Projects that were already minting on Arbitrum. Over the past month, 4 of the top 10 NFT projects, as listed by OpenSea, have done more than 100% in Trading volume.

Another industry juggernaut, the well-known crypto wallet service provider MetaMask, 2 months ago, announced a layer 2 Integration with Arbitrum. With the upgrade, MetaMask users can now swap directly from their wallets and use the feature on MetaMask’s Portfolio Dapp. This opened the door of opportunity for Metamask and Arbitrum natives alike to use both the wallet and the blockchain, with the potential of increasing trading volumes on both platforms.

Recently, Rage Trade, one of the newest DEX Protocols launched its ETH perp features and Delta Neutral GLP vaults on the Arbitrum Network. These vaults are built using the GMX protocol and are designed to provide users with a way to hedge their positions in the market. In essence, the protocol helps users reduce risk and improve the stability of their investment portfolios.

Also recent is the announcement by Coinbase, which said the exchange would allow A subset of its users to transfer and receive Ethereum, Dai, and Wrapped Bitcoin (WBTC) using Arbitrum.

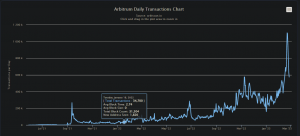

Transactions on Arbitrum

In the last 6 months, the daily trading volumes on Abritrum have increased over 1000, from over 107k transactions to an all-time high of 1.1 million transactions which reached the ATH in January this year.

With the daily transaction currently at over half a million and a total transaction record of over 120 million with the latest integrations and support on the Arbitrum network, it is easy to ask the question, Is Arbitrum Pumping?

According to a report in Nov 2022, Arbitrum reached the top 10 in monthly earnings, as the users’ behavior and historical analyses show multiple trends of rapid growth in transactions, total value locked, and daily active users at Arbitrum-based platforms. Over 30 days, from the date of the report, Arbitrum earned $1 million in fees, a 134.41% increase. The increase in fees also increased the 30-day revenue for the Arbitrum protocol by 46.91%.

Possible Questions

Although the blockchain n currently does not have its own native token, there have been various speculations about the launch of an ARBI Token, although it hasn’t been confirmed by the Arbitrum.

Will we see more adoption of Arbitrum? As the integrations increase? Will the blockchain’s utility? Will more and more projects build, bridge, or integrate with the Blockchain that offers a faster and cheaper Ethereum solution?

In 2023, layer 2 blockchain is setting itself up as one blockchain to watch in the coming months, as more projects can be expected to announce their and adoption and integration into the network As an investor, keeping your eyes on Arbitrum could increase your investment portfolio.

Read also;

Pingback: Is Arbitrum Pumping? See how the L2 has performed in 5 months by Chigozie Ohakwe Michael – CryptoTvplus Events: NFT, DeFi, Bitcoin, Ethereum, Altcoin Events