News

Kucoin hacker is dumping ERC20 tokens via Uniswap. Does this leave Dexes in a bad light?

Right after every crypto exchange hack, it’s normal to see the crypto community lurking around to see when the hacker moves funds. The Kucoin hack has been no exception.

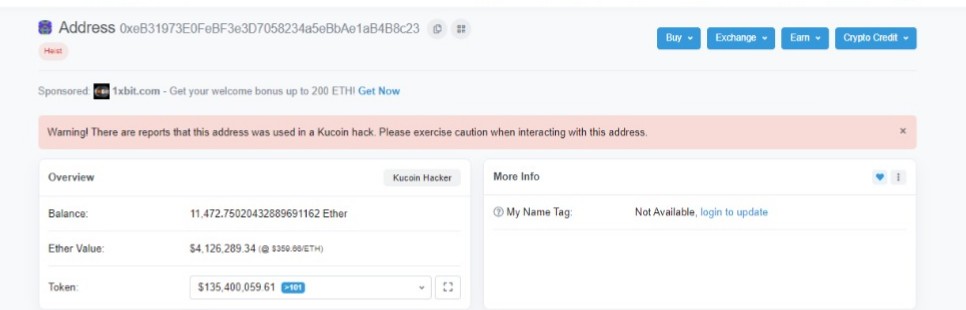

Popular crypto exchange Kucoin in the early hours of Sept 26th confirmed via its Twitter handle that the exchange was hacked, although they guaranteed to cover any affected user funds through their insurance fund. The losses were estimated at around $150 million of cryptocurrency – 1008 BTC, 14,713 BSV, 26,733, 9,588,383 XLM, $14m USDT (Omni and EOS based), over 18m XRP, and $153m in ether and other ERC20 tokens.

Kucoin CEO, Johnny Lyu, has continued to update the crypto community on every progress made regarding the incident.

In the early hours of Sunday, the hacker began to move a large number of stolen ERC 20 tokens on decentralized exchange (Dex), Uniswap. A crypto user first observed and tweeted that the hacker was dumping the token “OCEAN”, dragging the price down by 10% in less than an hour.

A number of ERC20 tokens stolen by the hacker include Alchemy, Ampleforth, Trace, Utrust, Orion Protocol, V-ID, Synthetix, Digitex, Chainlink, Akropolis, and many more.

As a safety measure to prevent selling pressure and protect the community, a lot of the affected token teams such as ORN, KAI, NOIA, have completed 1:1 token SWAPs, rendering the previous tokens obsolete. The Ampleforth team quickly deployed a contract upgrade to disable transfers from the attacker while the Suterusu team plans to initiate a hardfork of the Suter Token Contract.

Several Kucoin users who watched Johnny Lyu address the situation in a Youtube Livestream were relieved and believed that Kucoin were handling the hack well.

Meanwhile, Larry Cermak, Director of Research at The Block Crypto, who watched the dumping in real-time stressed that a high profile incident like this could bring Uniswap into regulators’ spotlight, especially if the swapping continues.

Another industry leader who is concerned about the Uniswap dumping is Waves Protocol founder, Sasha Ivanov. In his words: #KuCoinHack hack showed us the future – stolen eth tokens are just dumped through uniswap, tracking down the hacker doesn’t seem very feasible. What is the solution to this? Don’t get hacked!

Exchange hacks don’t seem to trigger heavy market sell-offs anymore, as the general crypto market has remained fairly stable despite the Kucoin hack.

Over to you. Do you think Dexes like Uniswap will become a den for crypto hackers to dump tokens going forward? Will incidents like this will push further away the adoption of Dexes? Tell us your thoughts.