Education

All you need to know about DeDust

Crypto users are increasingly turning to decentralized exchanges (DEXes) due to their enhanced security, privacy, and control over funds. According to Token Terminal, decentralized exchanges (DEXs) have around 500,000 daily active users.

Additionally, as of January 2024, more than 40 million unique traders have participated in DEX trading, with the number now up to 43 million.

This nature of DEXes allows users to interact directly from their wallets without depositing funds, ensuring greater privacy and security. Additionally, DEXes provide access to a wider range of tokens for trading, making them an attractive option for those looking to explore various cryptocurrency opportunities.

DeDust has emerged as a popular decentralized exchange (DEX) on the TON blockchain, providing users with access to decentralized services similar to those offered by established platforms like Uniswap and PancakeSwap.

What is DeDust?

DeDust is a decentralized exchange (DEX) built on The Open Network (TON blockchain). It allows users to trade TON and TON-based digital assets in a fully decentralized way. The advanced DeDust Protocol 2.0, focuses on improving user experience, reducing gas fees, and being scalable, making it a strong option for trading cryptocurrencies.

DeDust was created by Nick Nekilov, the same developer behind Scaleton, but it has undergone significant changes and is not just a new version of Scaleton. Since its launch in 2022, DeDust has evolved significantly, serving thousands of users and introducing notable features, including a staking program for its native SCALE token on May 2, 2024.

Core features of DeDust

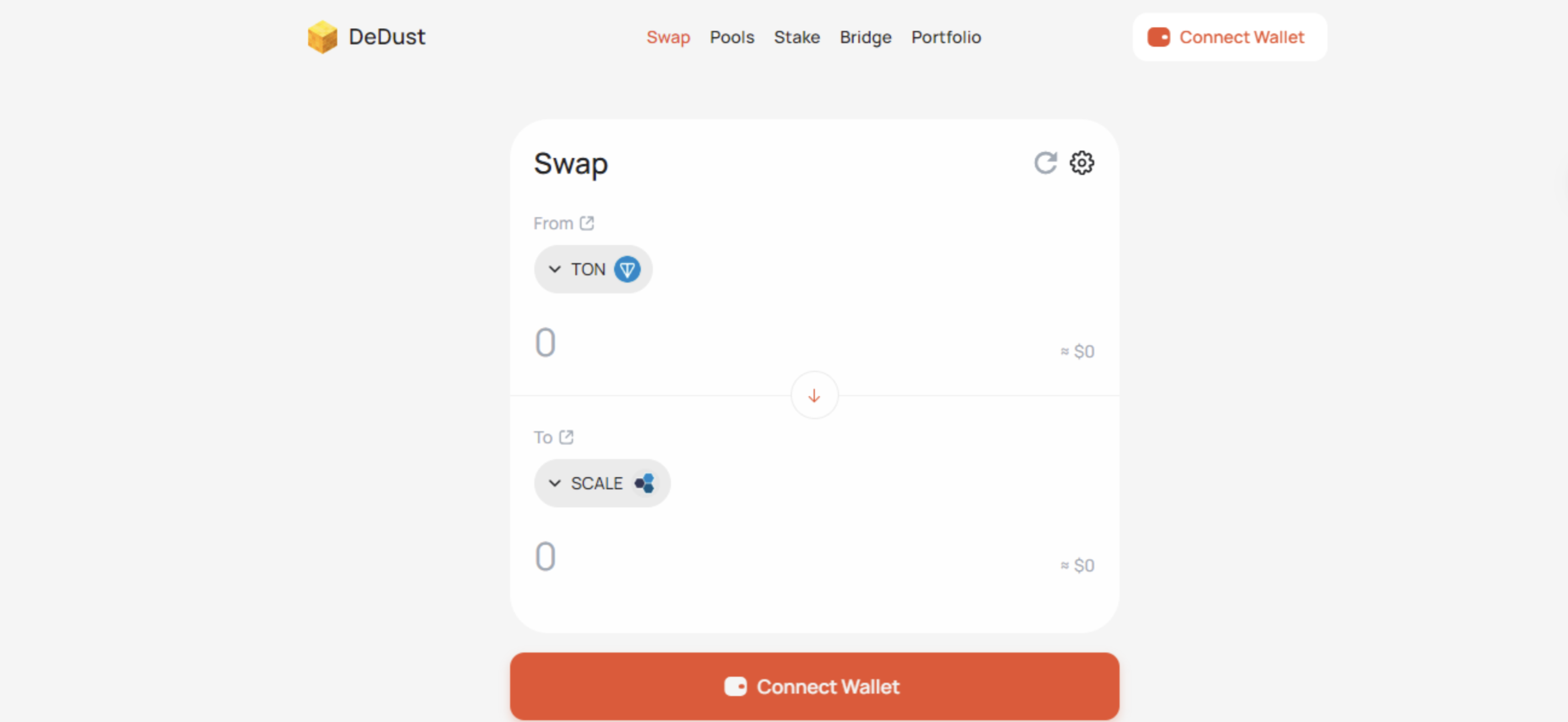

Swapping

DeDust users can swap one token for another on the DEX, and this can either be done on desktop or mobile versions of the DeDust website. It can also be done through the built-in browser of a mobile application wallet of MyTonWallet or Tonkeeper.

Here’s how to swap on DeDust DEX:

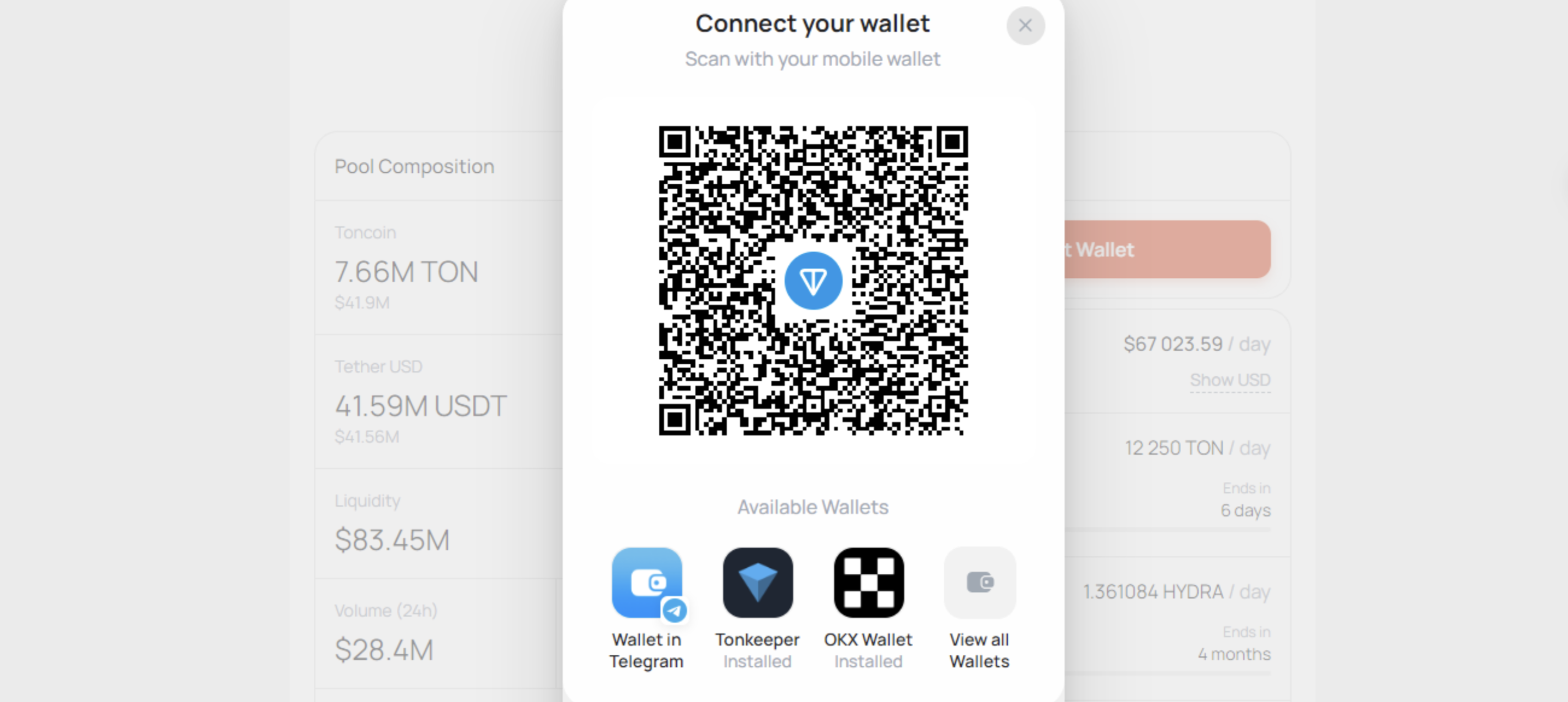

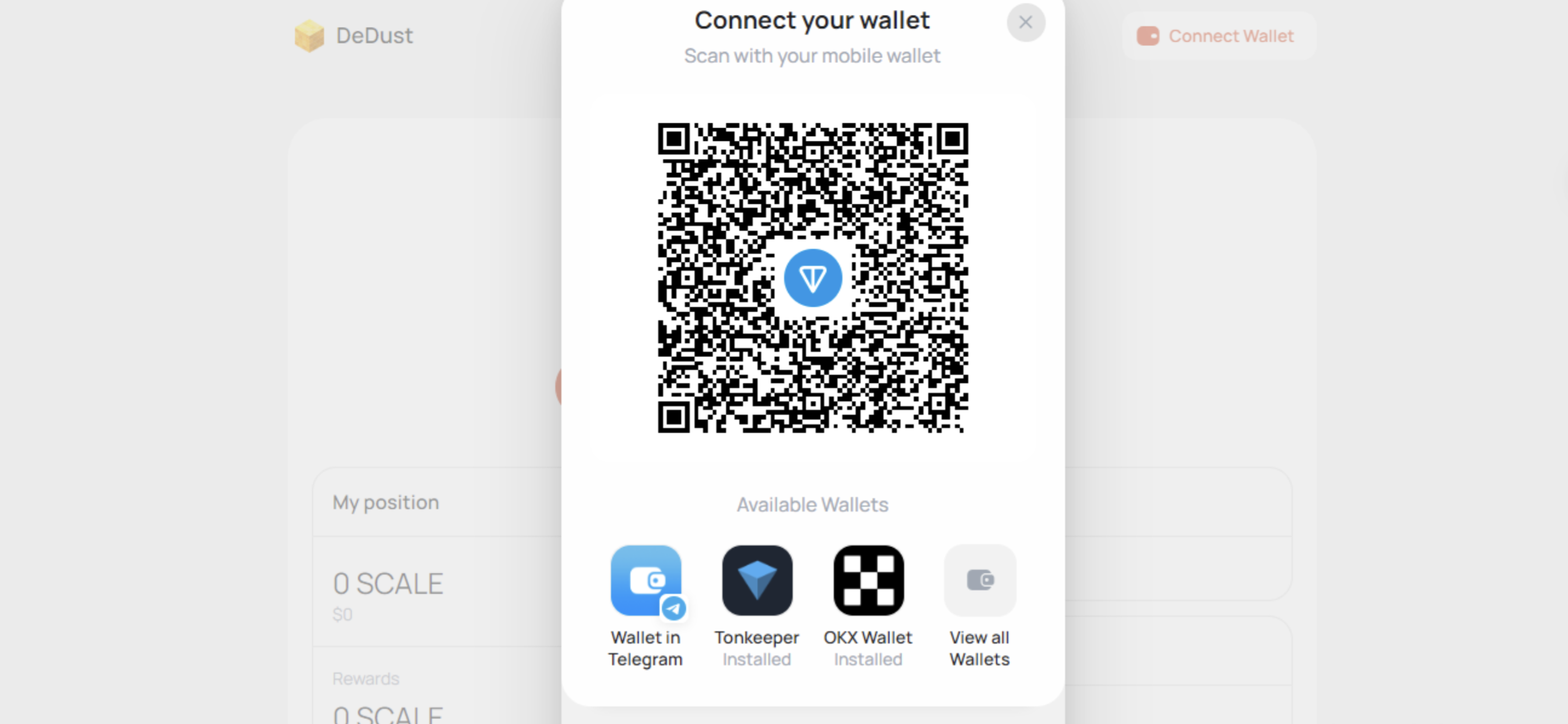

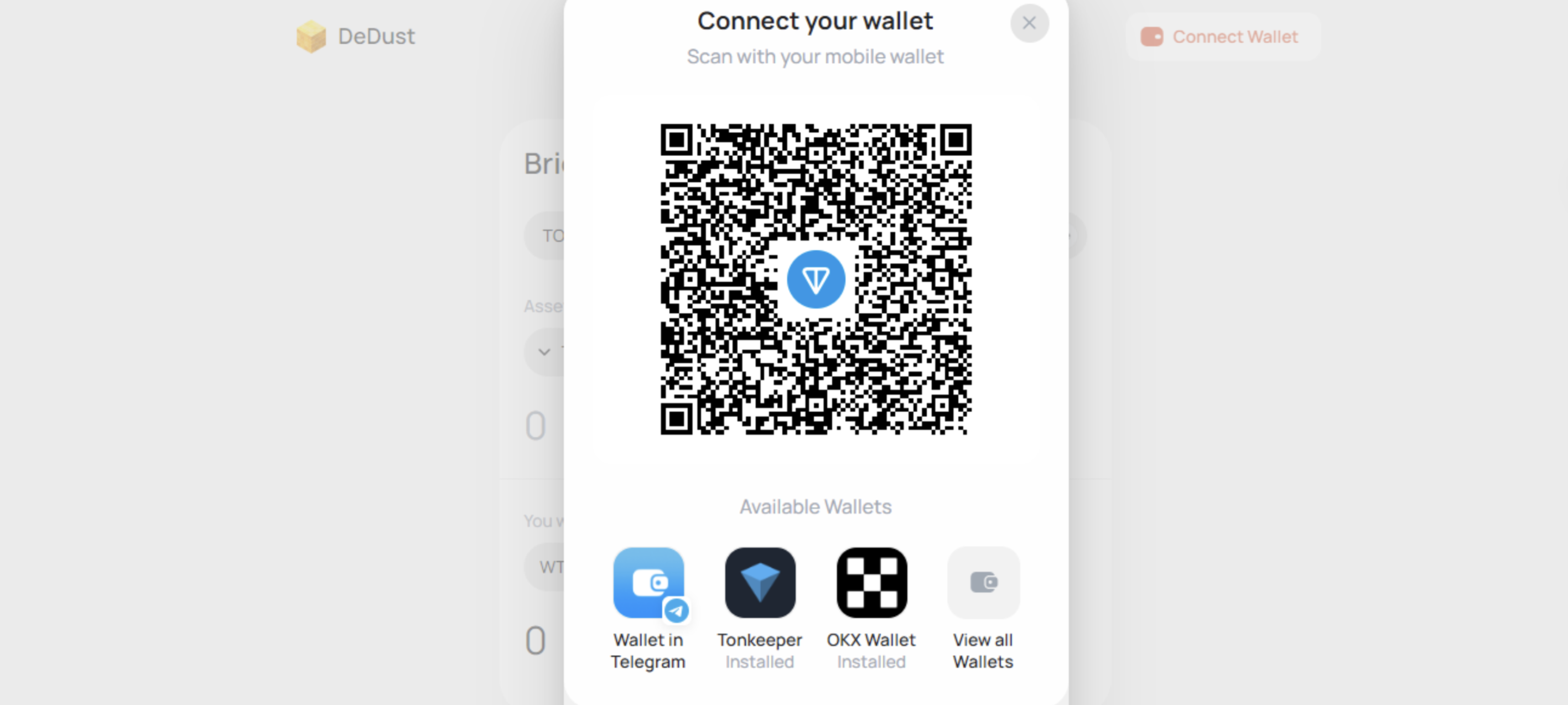

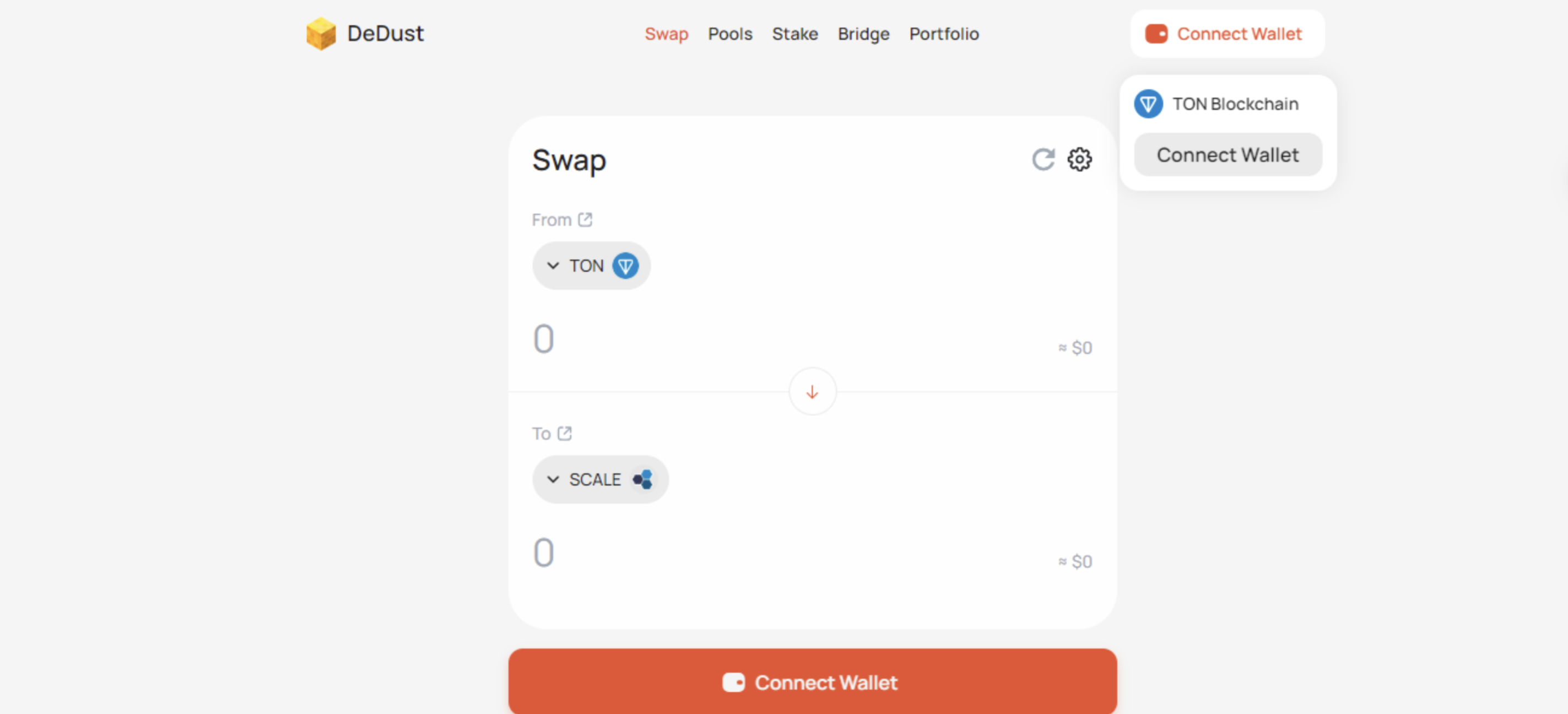

1. Connect wallet

This can be any wallet – such as Trust Wallet, Metamask, or Tonkeeper – so long it supports TON-based tokens.

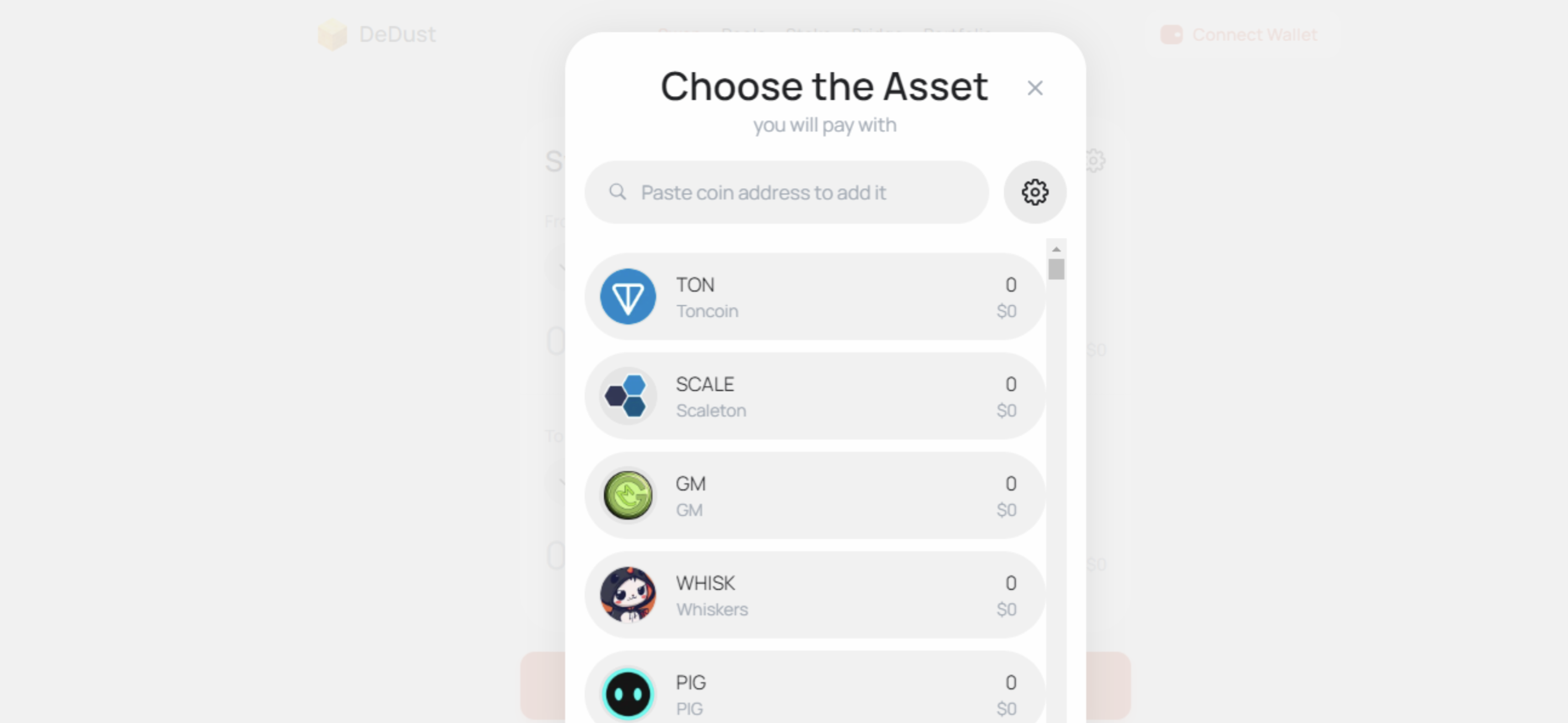

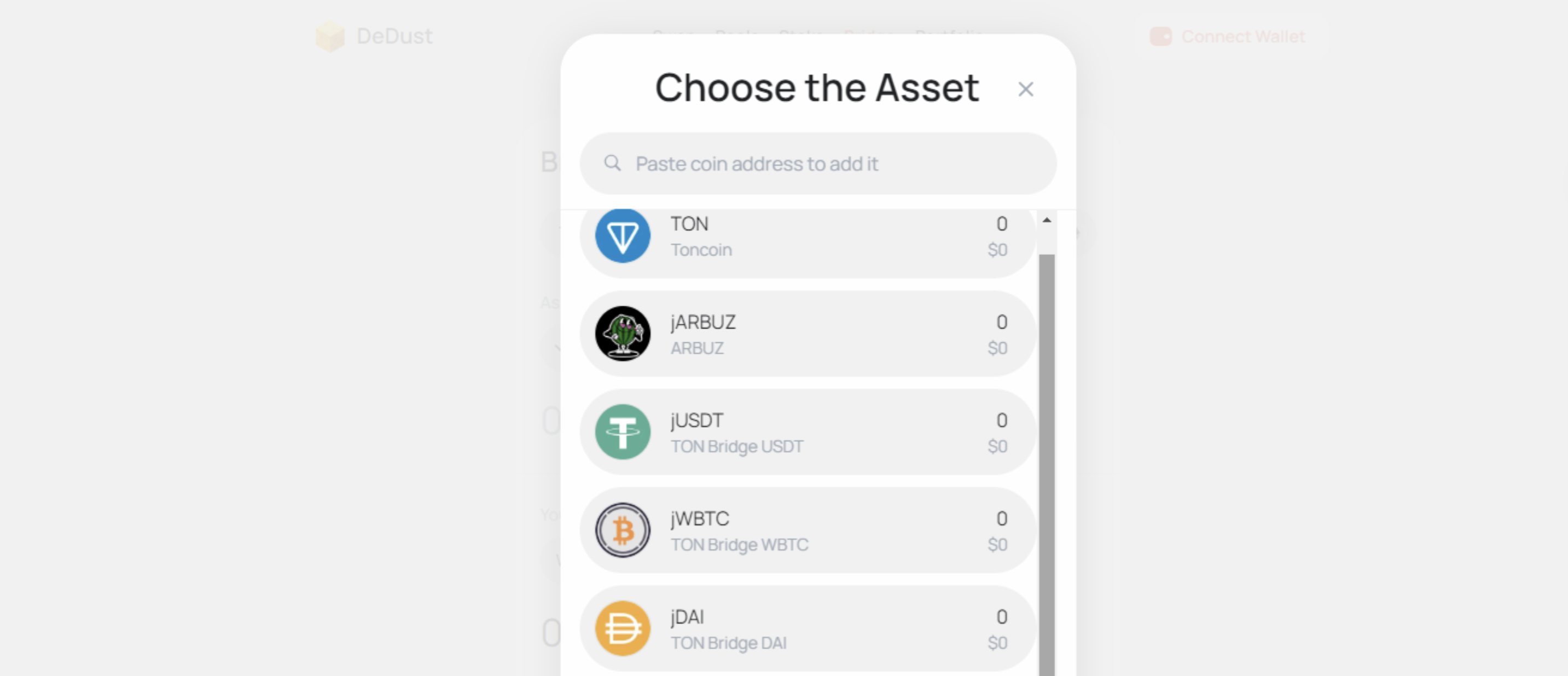

2. Select the desired tokens and carry out the swap

Liquidity pool

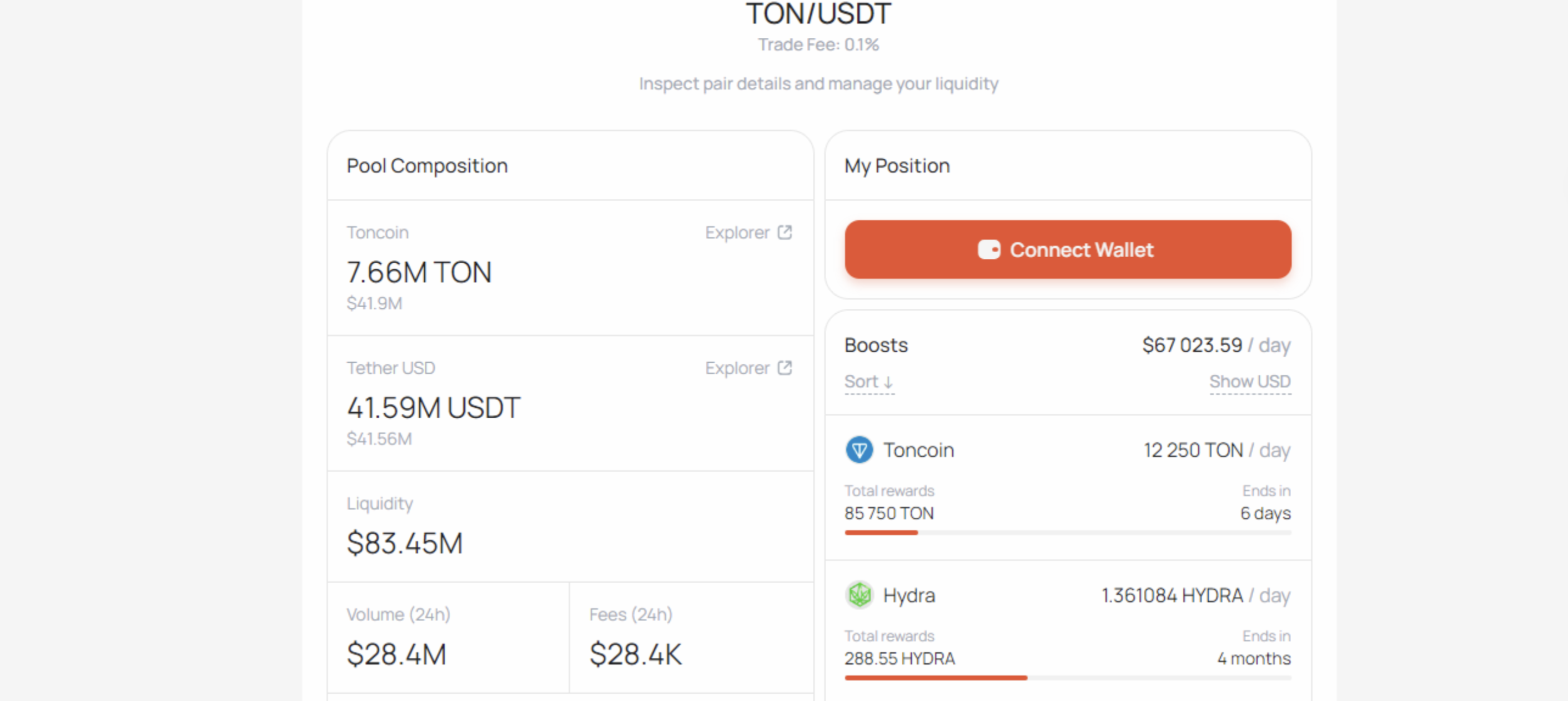

DeDust also has a liquidity pool that users can participate in and be rewarded for the liquidity they provide. Liquidity pools are collections of funds locked in smart contracts that provide liquidity for trading on decentralized exchanges (DEXs).

Users, known as liquidity providers (LPs), contribute assets to these pools, allowing for seamless trading without the need for traditional market makers. When users trade tokens, the automated market maker (AMM) adjusts prices based on supply and demand within the pool, ensuring efficient market operations.

How to participate in the liquidity pool

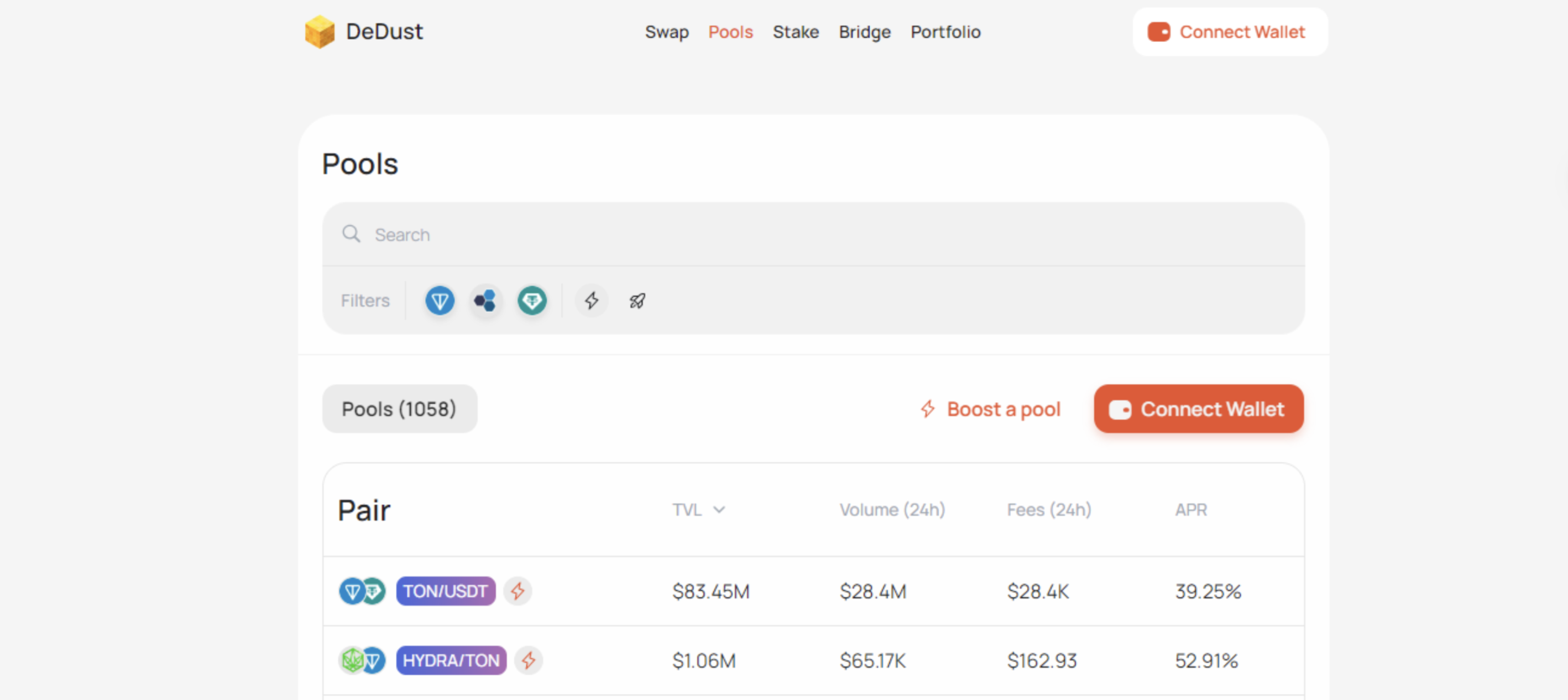

1. Open the DeDust Liquidity Pool portal and select a pool

Several pools have been created in the Liquidity Pool of DeDust. One of the most popular is the TON/USDT pool.

2. Connect the wallet and deposit the tokens needed for the pool.

DeDust also has what is called Boost. A Boosted pool gives extra rewards to people who add their cryptocurrencies to the pool. If a user adds liquidity to the pool, they will get their share of the trading fees plus some extra rewards. User can also create a liquidity pool.

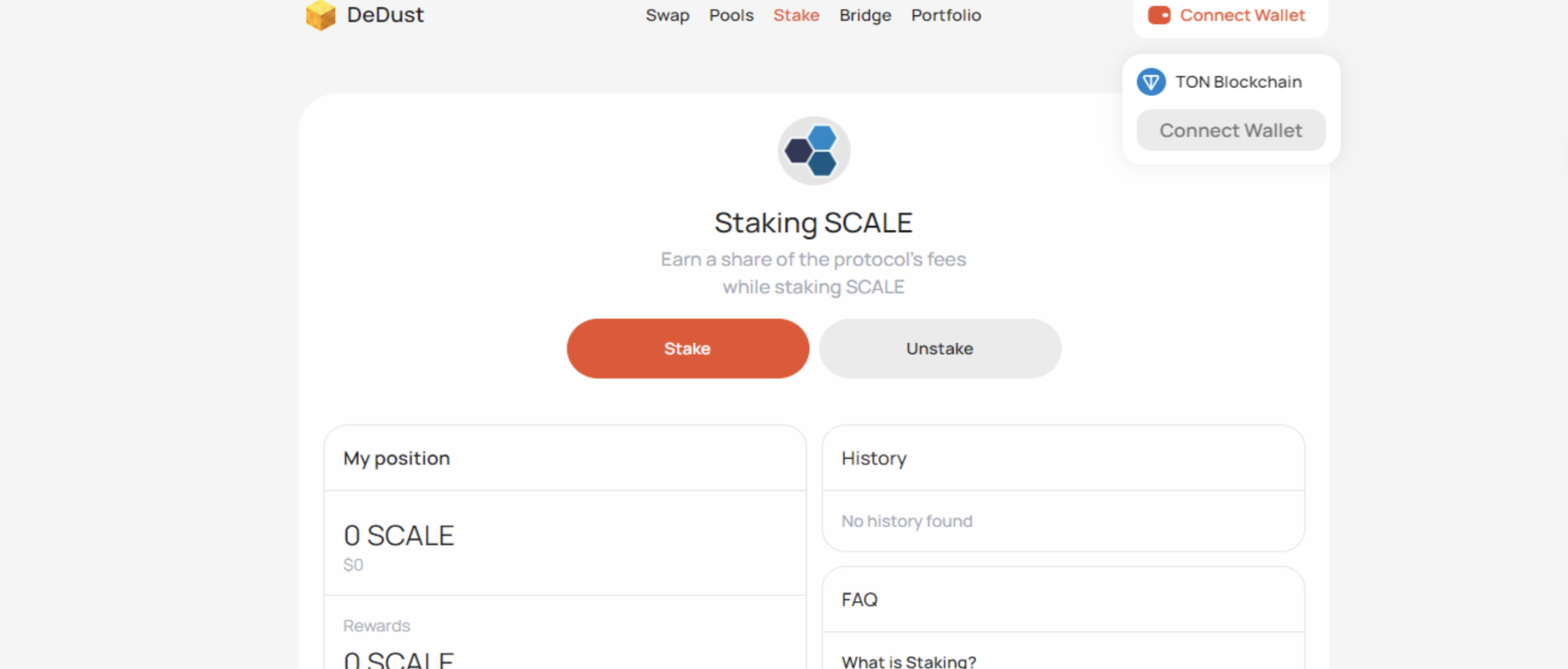

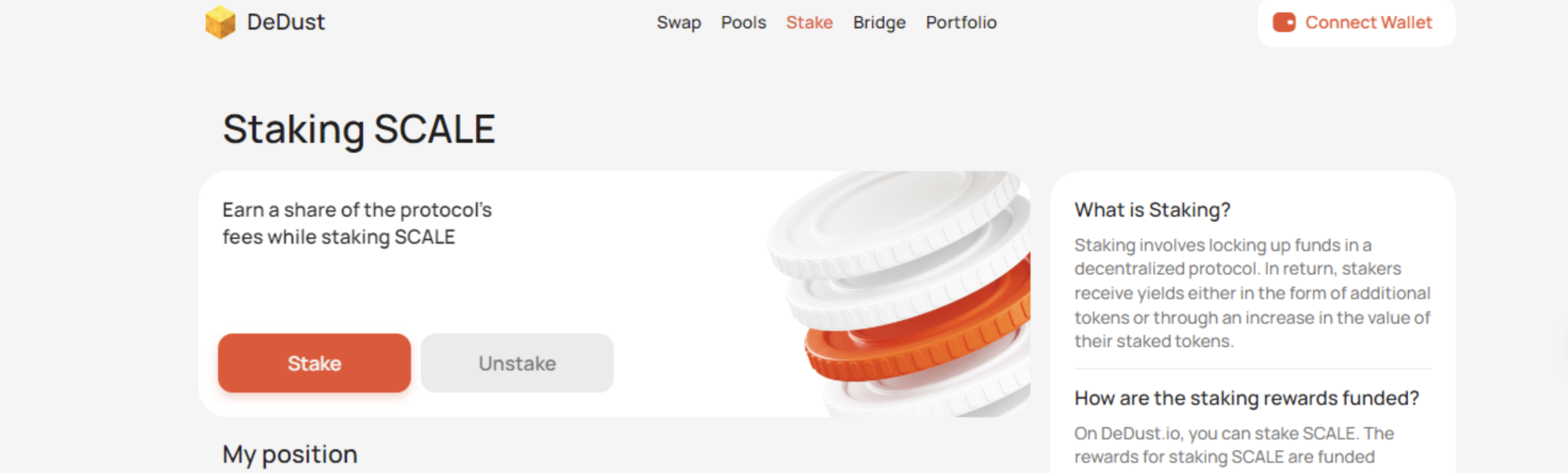

Staking

Staking means putting your money into a decentralized system and leaving it there for a while. In return, you earn rewards, which could be extra tokens or an increase in the value of the tokens you staked. On May 2nd, DeDust introduced staking for its native token, $SCALE.

Here’s how to stake on DeDust

1. Open the Staking portal and connect the wallet

2. Add the required token to stake.

$SCALE is the required token for staking on DeDust. The rewards for staking SCALE are funded through the distribution of fees collected by the platform.

Additionally, if a user wants to unstake, a click on the Unstake button option is enough. There are two options to unstake: unstake immediately with a 5% penalty or wait 72 hours to avoid a service fee.

There is a network fee that will apply in both cases, as it is required to process users’ transactions on the blockchain. When a user unstakes, the proportional amount of rewards will also be withdrawn along with their tokens.

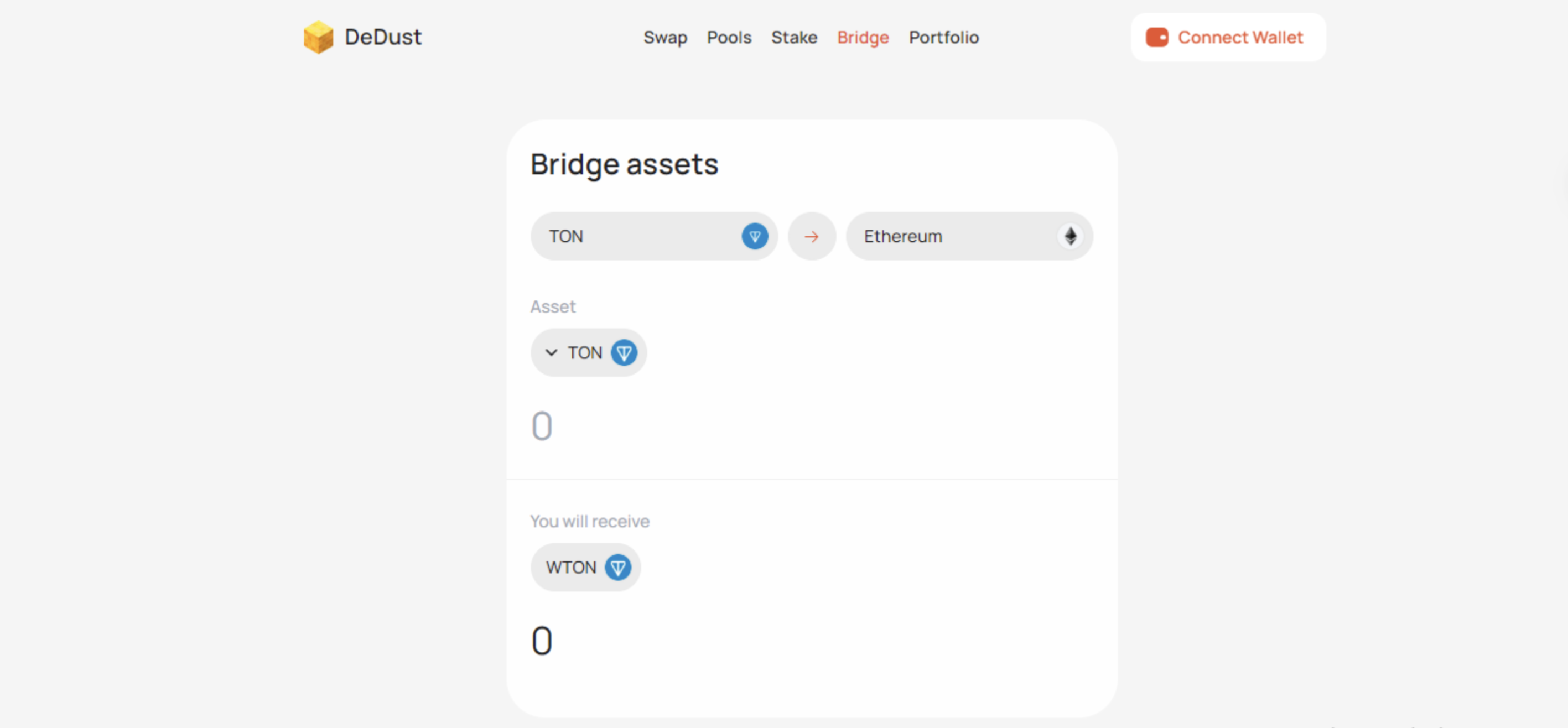

Bridge

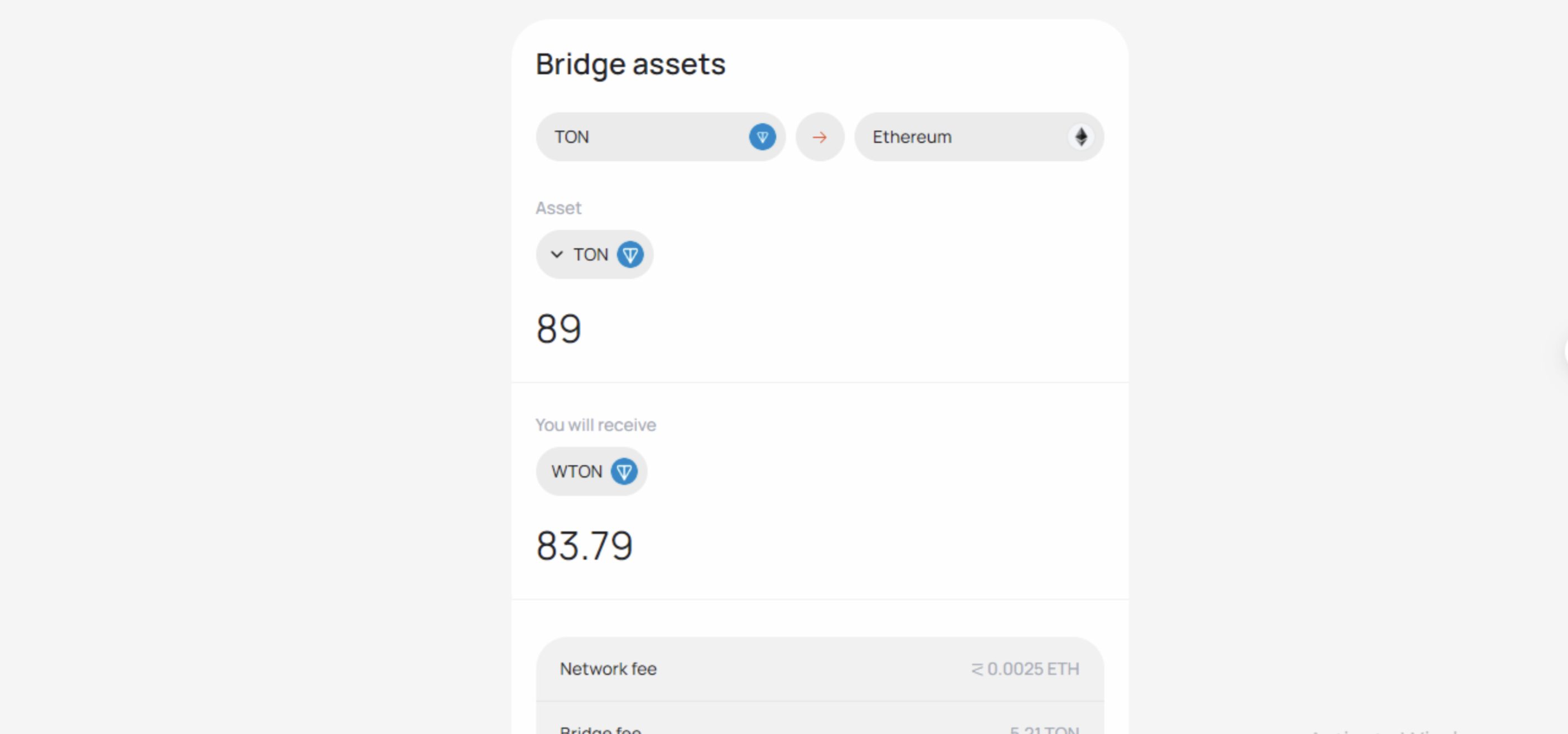

Bridge is the next feature present in DeDust. In Web3, “bridging” refers to moving assets or data from one blockchain to another. Since different blockchains often have their own rules, tokens, and protocols, they can’t easily communicate with each other. A bridge acts as a link that allows users to transfer tokens, NFTs, or other assets between these separate blockchains.

For example, if a user has a token on Ethereum and wants to use it on another blockchain like TON blockchain, the user will need a bridge. The bridge locks up the token on Ethereum and then creates an equivalent token on TON blockchain for the user. This way, anyone can move assets across different platforms while keeping their value.

To Bridge a token on DeDust:

1. Open the Bridge portal and connect wallet

2. Select the token to bridge and amount.

3. Bridge the token and receive it on another chain.

Portfolio

DeDust has a portfolio feature that lets users easily manage and view their cryptocurrency. It shows what tokens they own, their liquidity positions, and any rewards they’ve earned from things like liquidity pools or staking.

Users can check their net worth, which shows the total value of everything in their portfolio, and keep track of rewards from activities on the platform.

The portfolio also shows how much of each token they have, details about staked tokens, and the rewards earned from staking.

The creation and listing of tokens are available on DeDust. With the help of the Ton Minter, any user can create a desired token and list it on DeDust.

Tokenomics of $SCALE

The total supply of the $SCALE token is 21 million. Out of this, 4.3 million tokens have been burned, meaning they are permanently removed from circulation. Around 5.46 million tokens are available on the market. A portion of 548,000 tokens is reserved for marketing, while 1.23 million tokens are set aside for development. The core team has 4.2 million tokens allocated to them, and 5.25 million tokens are held in the ecosystem fund.

On May 2, 2024, DeDust introduced SCALE staking. The fees collected from the platform are used to buy back SCALE tokens, which are then distributed to users who stake their tokens. Of the fees collected, 80% goes to liquidity providers, and the remaining 20% is converted into SCALE tokens and distributed to stakers.

For instance, if the trading fee is 0.25%, 0.20% of the trading volume goes to liquidity providers, and 0.05% is given as staking rewards. Currently, there are 2.2 million $SCALE tokens, valued at $7.18 million, staked on the platform.

Regarding fees on DeDust, the default fee for swapping one token for another is 0.4%. In some cases, the fee may be adjusted based on specific requests from token founders, and this custom fee is displayed on the pool page.

Community base, partnerships, and future development

DeDust has a Telegram Community of more than 65,000 subscribers, X exceeds 70,000, and it has struck partnership deals with platforms such as Tonhub, OKX, Coinmarketcap, and DeFiLlama.

Upcoming developments include advanced trading features like limit orders, derivatives trading, and potentially cross-chain functionality, allowing users to trade assets from other blockchains directly on DeDust.

Pingback: بهترین صرافیهای غیرمتمرکز (DEX) شبکه تون برای ایرانی ها