News

SEC Chair says blockchain promises new market opportunities

On Monday, Paul Atkins, the Chair of the Securities & Exchange Commission (SEC), addressed the Crypto Task Force roundtable and outlined his administration’s plan to prioritize crypto regulations. He highlighted that the focus would be on areas such as token issuance, custody, and trading.

Blockchain technology could enable “a broad swath of novel use cases for securities” and foster “new kinds of market activities that many of the Commission’s legacy rules and regulations do not contemplate today,” said Securities and Exchange Commission (SEC) Chairman Paul Atkins.

The SEC Chair spoke at the 4th Crypto Task Force roundtable, where he revealed his intentions to implement digital asset regulations in the US, focusing on prioritizing the development of a practical and rational framework for crypto during his tenure.

“The Commission must keep pace with innovation and consider whether regulatory changes are needed to accommodate on-chain securities and other crypto assets,” said Atkins

Atkins claimed that conventional securities laws cannot accommodate on-chain assets and could “stifle the growth of blockchain technology.” He emphasized that the Commission’s policymaking will shift away from “ad hoc enforcement actions” to prioritize the creation of clear standards for market participants.

Atkins identified issuance, custody, and trading as the three central pillars his administration will address in its approach to crypto regulations.

He stated that the Commission will commit to outlining transparent procedures for the issuance and circulation of digital assets falling within the securities category.

It will also focus on supporting market participants by providing clear pathways for securely storing their crypto holdings.

Moreover, Atkins highlighted the need to ensure that innovators in the blockchain space don’t feel the need to leave the US to advance their work.

He noted that the administration is open to granting “exemptive relief” to entities aiming to develop novel products that don’t entirely comply with the Commission’s present regulations.

Atkins took office as the new SEC Chair on April 21, replacing Gary Gensler, who was frequently viewed as having an anti-crypto stance during his administration.

Since his Senate approval, Atkins has made it clear that he supports digital assets and intends to establish the US as the epicenter of crypto innovation.

Tokenizing securities is a hot topic that sits at the convergence of traditional finance and the crypto industry.

BlackRock and Franklin Templeton have entered the tokenization space with their BUIDL and BENJI tokenized US treasury funds.

Robinhood is contemplating the construction of a blockchain aimed at facilitating the trading of tokenized US securities by European retail investors.

Due to benefits such as faster settlements, lower reliance on traditional financial frameworks, and improved access, tokenized securities could capture the interest of firms and brokerages.

Asset classes that have struggled with liquidity in the past could benefit from tokenization, which may help improve their tradability.

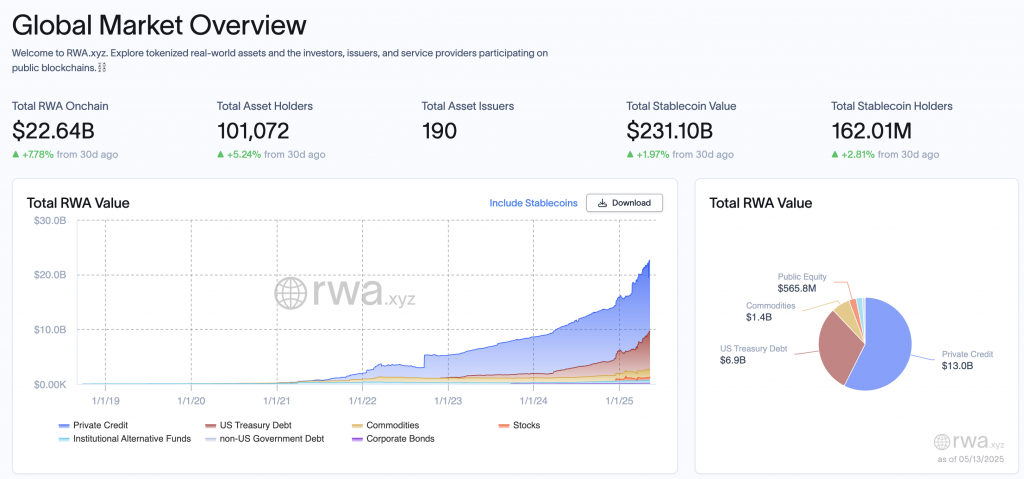

As per RWA.xyz, real-world assets on the blockchain have surged to $22.6 billion, showing a 7.6% increase in just 30 days.

Stablecoins, which are often supported by real-world assets like treasury bills, do not contribute to this total.

As of May 12, DefiLlama data shows stablecoins have a market cap of $243 billion, and Tether’s USDt alone accounts for $150.6 billion.

Pingback: XRP Whale Transfers: What They Mean for Investors – FlowFeed