News

Ethereum DEXes regains top position for the first time in 2025

Ethereum’s Decentralized Exchanges (DEXs) surpassed Solana’s for the first time in 2025, marking the end of Solana’s rapid growth phase. Ethereum recorded over $64 billion in trading volume, while Solana exceeded $52 billion. BSC, Arbitrum, Base, Sui, and Avalanche followed in the rankings.

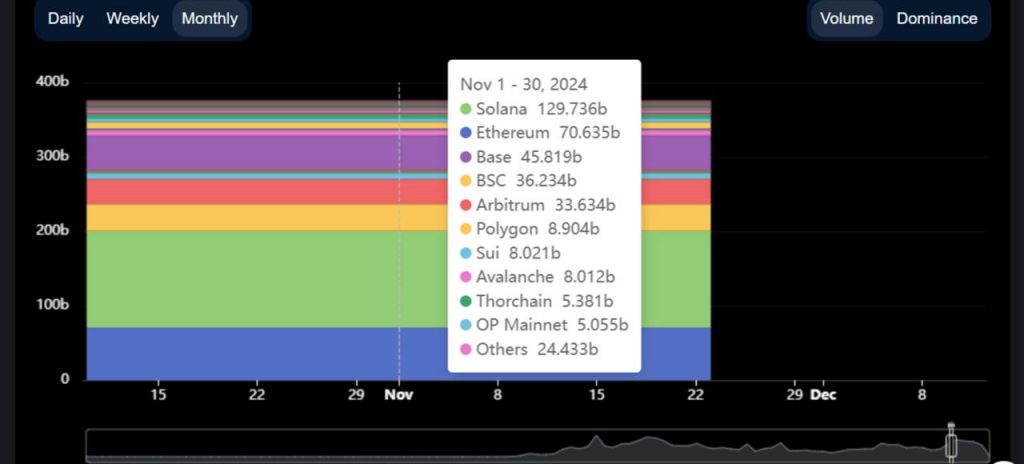

Solana’s DEXes outpaced Ethereum’s from October 2024 to February 2025 due to its superior speed and cheap fees, the memecoin trading boom led by platforms like Pump.fun and Raydium, and Ethereum’s fragmentation across Layer-2s.

During this period, Solana reached its peak dominance, with trading volumes soaring to $100 billion in November 2024. However, by March 2025, Ethereum DEXes led in trading volume, according to Defillama data.

One of the factors that contributed to this is that Ethereum continues to attract institutional traders who prefer its deep liquidity and established reputation. While Solana’s rise was driven by retail traders speculating on memecoins, Ethereum’s DEXs remained the preferred choice for swapping stablecoins and blue-chip assets.

In the first week of March, approximately $1.8 billion flowed from centralized exchanges into Ethereum’s DeFi protocols, including DEXes, even as ETH prices remained stagnant around $2,100. This movement occurred despite a major setback in 2025—a $45 billion decline in DeFi’s total value locked (TVL) since December 2024.

Second, Ethereum’s Layer-2 solutions, like Arbitrum and Base, have significantly improved scalability. These networks reduced transaction fees and increased speed, addressing one of Solana’s biggest advantages. In March 2025, Base and Arbitrum DEXs saw volume spikes. Traders were increasingly comfortable using Ethereum’s scaling solutions instead of moving to Solana.

Check Out: Fidelity’s “Onchain” Ethereum Treasury Fund Filing

Third, Ethereum’s composability—how well its different protocols interact—gave it a stronger foundation. Its DEXs integrate seamlessly with lending platforms, yield farming, and other DeFi tools, such as Aave, Compound, Lido, and Curve Finance, creating a more resilient and versatile ecosystem.

Ethereum also saw the highest level of stablecoin inflow in March, surpassing $130 billion. The USDT (Tether) supply on Ethereum exceeded $75 billion, USDC (USD Coin) followed with a supply of just over $39 billion, and USDe accounted for $5.39 billion.

USDS (Stably USD) held $4.49 billion, and DAI maintained a supply of $2.95 billion. FDUSD (First Digital USD) contributed $2.07 billion, while PYUSD (PayPal USD) had a supply of $714.23 million.

Tron, BSC, Solana, Base, and Arbitrum attracted about $66 billion, $7 billion, $12 billion, $4 billion, and $3 billion in stablecoin flow. The combined number does not add up to the value on Ethereum, which now represents over half of the total stablecoin market capitalization.