News

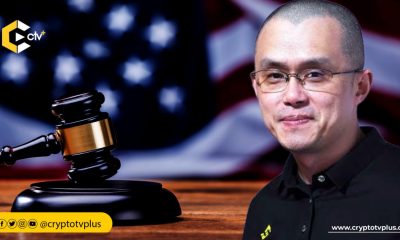

Federal Court orders CZ to pay $150 million, Binance $2.7 billion

The U.S. District Court for the Northern District of Illinois has officially approved and entered a consent order against Binance and its former CEO, Changpeng Zhao, concluding the enforcement action initiated by the Commodity Futures Trading Commission (CFTC).

The court’s decision, formalizing a settlement first disclosed on November 21 [CFTC Press Release No. 8825-23], signifies a landmark moment in the CFTC’s efforts to enforce regulatory compliance in the digital asset space.

The order, which stems from violations of the Commodity Exchange Act (CEA) and CFTC regulations, imposes substantial penalties on both Zhao and Binance.

A breakdown of the order reveals that Changpeng Zhao, also known as CZ, will personally pay $150 million in civil monetary penalties.

Meanwhile, Binance, along with its affiliated entities Binance Holdings Limited, Binance Holdings (IE) Limited, and Binance (Services) Holdings Limited, is also obligated to release $1.35 billion of ill-gotten transaction fees. In addition, Binance will pay a $1.35 billion penalty to the CFTC.

The court’s findings reveal that Binance, under Zhao’s direction, actively solicited customers in the United States, including quantitative trading firms, for digital asset derivative transactions.

It added that the platform allowed prime brokers to open “sub-accounts” that circumvented Binance’s know-your-customer (KYC) procedures, enabling U.S. customers to trade directly on the platform in violation of its Terms of Use.

The court noted that CZ and Binance were fully aware of U.S. regulatory requirements but deliberately chose to ignore them.

Furthermore, they knowingly concealed the presence of U.S. customers on the platform, with senior management actively facilitating violations of U.S. law, including instructing U.S. customers to evade compliance controls.

As part of the order, Binance and Zhao have provided certifications outlining the corrective measures taken following the CFTC’s complaint.

This includes the offboarding of identified quantitative trading firms and the implementation of enhanced onboarding criteria.

Binance commits to enforcing KYC onboarding procedures for all customers, eliminating sub-accounts that bypass compliance controls, and establishing a robust corporate governance structure.

In a separate order, Binance’s former Chief Compliance Officer, Samuel Lim, has been mandated to pay a $1.5 million civil penalty.

This penalty is tied to Lim’s role in aiding Binance’s violations and engaging in activities outside the U.S. to evade U.S. law deliberately.

Read also; NEWSCertik finds remote code execution vulnerability in OKX app