News

FTX: Is Alameda moving funds days after SBF’s bail?

Just days after the former CEO Sam Bankman Fried was released on a $250 million bond, money was discovered leaving the cryptocurrency wallets linked to the now-defunct trading firm Alameda Research, the sister company of FTX.

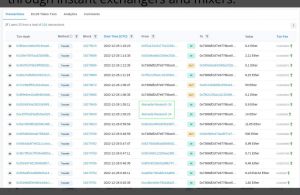

More than only raising questions about the transfer of money from Alameda wallets, the community was intrigued by how this cash was moved. The Alameda wallet was discovered to be exchanging ERC20 token bits for ETH/USDT, after which the Ether was routed to immediate exchangers and mixers.

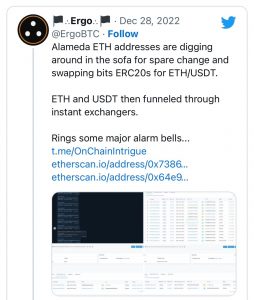

An OTX researcher on Twitter Ergo_BTC claimed that Alameda ETH addresses are digging around in the sofa for spare change and swapping bits of ERC20s for ETH/USDT. ETH and USDT were then funneled through instant exchangers.

On-chain expert ZachXBT further confirmed this observing that the Alameda wallet eventually exchanged the funds for Bitcoin via decentralized exchanges like FixedFloat and ChangeNow. Hackers and other exploiters frequently utilize these platforms to conceal their transaction routes.

Every day brings a new twist to the never-ending FTX issue, and the community is concerned about the most recent transfer of money to extract whatever is still in those cryptocurrency wallets.

Many people hypothesized that the way these funds are being transferred appears to be exploitative, but considering that Bankman-Fried is now known to have a criminal record, many people also thought it might be an inside job to remove whatever money is still in those wallets.

With many speculating that this is SBF’s doing, the role of Caroline Ellison the CEO of Alameda Research should also be undermined. Caroline Ellison and the former CEO of FTX, Sam Bankman-Fried both have access to FTX’s funds and any of them can be responsible for this transaction.

AZcrypt took to Twitter claiming that “The call is coming from inside the house…”

Others inquired why he was permitted access to the internet and questioned the bail requirements. A Twitter user questioned why the former CEO’s bail conditions included being unable to use a computer or the internet while “desperately trying to funnel money out.”

Who is responsible for this transaction and with this new development, is the possibility of a refund still feasible?

Read also;

Mango markets exploiter, Avraham Eisenberg arrested for market manipulation

Pingback: FTX: Is Alameda moving funds days after SBF’s bail? by Micah Bamigboye – CryptoTvplus Events: NFT, DeFi, Bitcoin, Ethereum, Altcoin Events

Pingback: FTX vs BlockFi: Court to send Robinhood shares into escrow account | CryptoTvplus: DeFi, NFT, Bitcoin, Ethereum Altcoin, Cryptocurrency & Blockchain News, Interviews, Research, Shows